Exhibit 99.3

[FORM OF PRELIMINARY PROSPECTUS SUPPLEMENT TO BE USED IN

CONJUNCTION WITH FUTURE RIGHTS OFFERINGS](1)

PRELIMINARY PROSPECTUS SUPPLEMENT

(to Prospectus dated , 20 )

Up to [ ] Shares

New Mountain Finance Corporation

Common Stock

Issuable Upon

Exercise of Rights

New Mountain Finance Corporation (“NMFC”, the “Company”, “we”, “us” and “our”) is a Delaware corporation that was originally incorporated on June 29, 2010. We are a closed-end, non-diversified management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. Our investment objective is to generate current income and capital appreciation through the sourcing and origination of debt securities at all levels of the capital structure, including first and second lien debt, notes, bonds and mezzanine securities. In some cases, our investments may also include equity interests. Our primary focus is in the debt of defensive growth companies, which are defined as generally exhibiting the following characteristics: (i) sustainable secular growth drivers, (ii) high barriers to competitive entry, (iii) high free cash flow after capital expenditure and working capital needs, (iv) high returns on assets and (v) niche market dominance.

The investments that we invest in are almost entirely rated below investment grade or may be unrated, which are often referred to as “leveraged loans”, “high yield” or “junk” debt investments, and may be considered “high risk” or speculative compared to debt investments that are rated investment grade. Such issuers are considered more likely than investment grade issuers to default on their payments of interest and principal and such risk of default could reduce our net asset value and income distributions. Our investments are also primarily floating rate debt investments that contain interest reset provisions that may make it more difficult for borrowers to make debt repayments to us if interest rates rise. In addition, some of our debt investments will not fully amortize during their lifetime, which could result in a loss or a substantial amount of unpaid principal and interest due upon maturity. Our debt investments may also lose significant market value before a default occurs. Furthermore, an active trading market may not exist for these securities. This illiquidity may make it more difficult to value our investments.

(1) In addition to the sections outlined in this form of prospectus supplement, each prospectus supplement actually used in connection with an offering conducted pursuant to the registration statement to which this form of prospectus supplement is attached will be updated to include such other information as may then be required to be disclosed therein pursuant to applicable law or regulation as in effect as of the date of each such prospectus supplement, including, without limitation, information particular to the terms of each security offered thereby and any related risk factors or tax considerations pertaining thereto. This form of prospectus supplement is intended only to provide a rough approximation of the nature and type of disclosure that may appear in any actual prospectus supplement used for the purposes of offering securities pursuant to the registration statement to which this form of prospectus supplement is attached, and is not intended to and does not contain all of the information that would appear is any such actual prospectus supplement, and should not be used or relied upon in connection with any offer or sale of securities.

We are issuing [transferable/non-transferable] rights to our stockholders of record, or record date stockholders, as of [ ] p.m., New York City time, on , 20 , or the record date. The rights entitle holders of rights, or rights holders, to subscribe for an aggregate of up to [ ] shares of our common stock. Record date stockholders will receive [ ] right(s) for each share of common stock owned on the record date. The rights entitle the holder to purchase [ ] new share(s) of common stock for every [ ] rights held, which we refer to as the basic subscription right[, and record date stockholders who fully exercise their rights will be entitled to subscribe, subject to certain limitations and pro-rata allocation, for additional shares that remain unsubscribed as a result of any unexercised rights.] [In addition, any non-record date stockholder who exercises rights will be entitled to subscribe, subject to certain limitations and pro-rata allocation, for any remaining shares that are not otherwise subscribed for by record date stockholders.]

The subscription price per share will be [describe means of computing subscription price]. Because the subscription price will be determined on the expiration date, stockholders who elect to exercise their rights will not know the subscription price per share at the time they exercise such rights. The rights will expire if they are not exercised by [ ] p.m., New York City time, on , 20 , the expiration date of this offering, unless extended. We, in our sole discretion, may extend the period for exercising the rights. You will have no right to rescind your subscription after receipt of your payment of the estimated subscription price or a notice of guaranteed delivery except as described in this prospectus supplement or accompanying prospectus.

This offering will dilute the ownership interest and voting power of the common stock owned by stockholders who do not fully exercise their subscription rights. Stockholders who do not fully exercise their subscription rights should expect, upon completion of the offering, to own a smaller proportional interest in us than before the offering. Further, if the net proceeds per share from the offering are at a discount to our net asset value per share, this offering will reduce our net asset value per share.

Our common stock is traded on the New York Stock Exchange under the symbol “NMFC”. On [ ], 2016, the last reported sales price on the New York Stock Exchange for our common stock was $[ ] per share.

An investment in NMFC’s common stock is very risky and highly speculative. Shares of closed-end investment companies, including business development companies, frequently trade at a discount to their net asset value. In addition, the companies in which NMFC invests are subject to special risks. See “Risk Factors” beginning on page [ ] of the accompanying prospectus to read about factors you should consider, including the risk of leverage, before investing in NMFC’s common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus supplement and the accompanying prospectus contain important information about NMFC that a prospective investor should know before investing in NMFC’s common stock. Please read this prospectus supplement and the accompanying prospectus before investing and keep it for future reference. NMFC files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (http://www.sec.gov), which is available free of charge by contacting NMFC by mail at 787 Seventh Avenue, 48th Floor, New York, New York 10019 or on our website at http://www.newmountainfinance.com. Information contained on our website is not incorporated by reference into this prospectus supplement and the accompanying prospectus, and you should not consider that information to be part of this prospectus supplement and the accompanying prospectus.

|

|

|

Per Share |

|

Total(4) |

|

|

Estimated subscription price(1) |

|

$ |

|

|

$ |

|

|

|

Sales Load (Underwriting Discounts and Commissions)(2)(3) |

|

$ |

|

|

$ |

|

|

|

Proceeds to us (before expenses)(1)(3) |

|

$ |

|

|

$ |

|

|

(1) Estimated on the basis of [describe means of computing subscription price]. See “The Offer—Subscription Price.”.

(2) [In connection with this offering, , the dealer manager for this offering, will receive a fee for its financial advisory, marketing and soliciting services equal to % of the subscription price per share for each share issued pursuant to the exercise of rights[, including pursuant to the over-subscription privilege.]

(3) We estimate that we will incur offering expenses of approximately $ in connection with this offering. We estimate that net proceeds to us after expenses will be $ assuming all of the rights are exercised at the estimated subscription price.

(4) Assumes all rights are exercised at the estimated subscription price.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

|

Page |

|

ABOUT THIS PROSPECTUS SUPPLEMENT |

S-ii |

|

PROSPECTUS SUPPLEMENT SUMMARY |

S-1 |

|

THE RIGHTS OFFERING |

S-10 |

|

FEES AND EXPENSES |

S-13 |

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

S-16 |

|

RISK FACTORS |

S-17 |

|

CAPITALIZATION |

S-17 |

|

USE OF PROCEEDS |

S-18 |

|

DILUTION |

S-19 |

|

PRICE RANGE OF COMMON STOCK |

S-20 |

|

THE OFFER |

S-23 |

|

LEGAL MATTERS |

S-35 |

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

S-36 |

|

AVAILABLE INFORMATION |

S-36 |

PROSPECTUS

[Insert table of contents from the base prospectus]

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. Neither we nor the underwriters have authorized any other person to provide you with different information from that contained in this prospectus supplement or the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to buy, any shares of our common stock by any person in any jurisdiction where it is unlawful for that person to make such an offer or solicitation or to any person in any jurisdiction to whom it is unlawful to make such an offer or solicitation. The information contained in this prospectus supplement and the accompanying prospectus is complete and accurate only as of their respective dates, regardless of the time of their delivery or sale of our common stock. This prospectus supplement supersedes the accompanying prospectus to the extent it contains information different from or additional to the information in that prospectus.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of [transferable/non-transferable] rights to our stockholders of record and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from the information contained in the accompanying prospectus, the information in this prospectus supplement shall control. Please carefully read this prospectus supplement and the accompanying prospectus together with any exhibits and the additional information described under “Available Information” and in the “Summary” and “Risk Factors” sections before you make an investment decision..

S-ii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights some of the information in this prospectus supplement and the accompanying prospectus. It is not complete and may not contain all of the information that you may want to consider. You should read carefully the more detailed information set forth under “Risk Factors” and the other information included in this prospectus supplement and the accompanying prospectus and the documents to which we have referred.

In this prospectus supplement, unless the context otherwise requires, references to:

· “NMFC”, the “Company”, “we”, “us” and “our” refers to New Mountain Finance Corporation, a Delaware corporation, which was incorporated on June 29, 2010, including, where appropriate, its wholly-owned direct and indirect subsidiaries;

· “NMF Holdings” and “Predecessor Operating Company” refers to New Mountain Finance Holdings, L.L.C., a Delaware limited liability company. References to NMF Holdings include its wholly-owned subsidiary, NMF SLF, unless the context otherwise requires. References to NMF Holdings exclude NMF SLF when referencing NMF Holdings’ common membership units, board of directors, and credit facility or leverage;

· “NMF SLF” refers to New Mountain Finance SPV Funding, L.L.C., a Delaware limited liability company;

· “SBIC GP” refers to New Mountain Finance SBIC G.P. L.L.C., a Delaware limited liability company;

· “SBIC LP” refers to New Mountain Finance SBIC L.P., a Delaware limited partnership;

· “Guardian AIV” refers to New Mountain Guardian AIV, L.P.;

· “AIV Holdings” refers to New Mountain Finance AIV Holdings Corporation, a Delaware corporation which was incorporated on March 11, 2011, of which Guardian AIV was the sole stockholder;

· “Investment Adviser” refers to New Mountain Finance Advisers BDC, L.L.C., our investment adviser;

· “Administrator” refers to New Mountain Finance Administration, L.L.C., our administrator;

· “New Mountain Capital” refers to New Mountain Capital Group, L.L.C. and its affiliates;

· “Predecessor Entities” refers to New Mountain Guardian (Leveraged), L.L.C. and New Mountain Guardian Partners, L.P., together with their respective direct and indirect wholly-owned subsidiaries prior to our initial public offering;

· “NMFC Credit Facility” refers to our Senior Secured Revolving Credit Agreement with Goldman Sachs Bank USA, Morgan Stanley Bank, N.A. and Stifel Bank & Trust, dated June 4, 2014, as amended (together with the related guarantee and security agreement);

· “Holdings Credit Facility” refers to NMF Holdings’ Second Amended and Restated Loan and Security Agreement with Wells Fargo Bank, National Association, dated December 18, 2014;

· “Predecessor Holdings Credit Facility” refers to NMF Holdings’ Amended and Restated Loan and Security Agreement with Wells Fargo Bank, National Association, dated May 19, 2011, as amended

· “SLF Credit Facility” refers to NMF SLF’s Loan and Security Agreement with Wells Fargo Bank, National Association, dated October 27, 2010, as amended;

· “Convertible Notes” refers to our 5.00% convertible notes due 2019 issued on June 3, 2014 and September 30, 2016 under an indenture dated June 3, 2014 (the “Indenture”), between us and U.S. Bank National Association, as trustee; and

S-1

· “Unsecured Notes” refers to our unsecured notes issued on May 6, 2016 and September 30, 2016 under an amended and restated note purchase agreement, dated September 30, 2016, to institutional investors in a private placement.

For the periods prior to and as of December 31, 2013, all financial information provided in this prospectus supplement reflects our organizational structure prior to the restructuring on May 8, 2014 described under “Description of Restructuring” in the accompanying prospectus, where NMF Holdings functioned as the operating company.

Overview

New Mountain Finance Corporation

We are a Delaware corporation that was originally incorporated on June 29, 2010. We are a closed-end, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). As such, we are obligated to comply with certain regulatory requirements. We have elected to be treated, and intend to comply with the requirements to continue to qualify annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended, (the “Code”). We are also registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

On May 19, 2011, we priced our initial public offering (the “IPO”) of 7,272,727 shares of common stock at a public offering price of $13.75 per share. Concurrently with the closing of the IPO and at the public offering price of $13.75 per share, we sold an additional 2,172,000 shares of our common stock to certain executives and employees of, and other individuals affiliated with, New Mountain Capital in a concurrent private placement (the “Concurrent Private Placement”). Additionally, 1,252,964 shares were issued to the partners of New Mountain Guardian Partners, L.P. at that time for their ownership interest in the Predecessor Entities. In connection with our IPO and through a series of transactions, NMF Holdings acquired all of the operations of the Predecessor Entities, including all of the assets and liabilities related to such operations.

New Mountain Finance Holdings, L.L.C.

NMF Holdings is a Delaware limited liability company. Until May 8, 2014, NMF Holdings was externally managed and was regulated as a BDC under the 1940 Act. As such, NMF Holdings was obligated to comply with certain regulatory requirements. NMF Holdings was treated as a partnership for United States (“U.S.”) federal income tax purposes for so long as it had at least two members. With the completion of the underwritten secondary offering on February 3, 2014, NMF Holdings’ existence as a partnership for U.S. federal income tax purposes terminated and NMF Holdings became an entity that is disregarded as a separate entity from its owner for U.S. federal tax purposes. See “Material Federal Income Tax Considerations”. For additional information on our organizational structure prior to May 8, 2014, see “Description of Restructuring”.

Until May 8, 2014, NMF Holdings was externally managed by the Investment Adviser. As of May 8, 2014, the Investment Adviser serves as our external investment adviser. The Administrator provides the administrative services necessary for operations. The Investment Adviser and Administrator are wholly-owned subsidiaries of New Mountain Capital. New Mountain Capital is a firm with a track record of investing in the middle market and with assets under management totaling more than $15.0 billion(1), which includes total assets held by us. New Mountain Capital focuses on investing in defensive growth companies across its private equity, public equity, and credit investment vehicles. NMF Holdings, formerly known as New Mountain Guardian (Leveraged), L.L.C., was originally formed as a subsidiary of Guardian AIV by New Mountain Capital in October 2008. Guardian AIV was formed through an allocation of approximately $300.0 million of the $5.1 billion of commitments supporting New Mountain Partners III, L.P., a private equity fund managed by New Mountain Capital. In February 2009, New Mountain Capital formed a co-investment vehicle, New Mountain Guardian Partners, L.P., comprising $20.4 million of commitments.

S-2

Prior to December 18, 2014, NMF SLF was a Delaware limited liability company. NMF SLF was a wholly-owned subsidiary of NMF Holdings and thus a wholly-owned indirect subsidiary of us. NMF SLF was bankruptcy-remote and non-recourse to us. As part of an amendment to our existing credit facilities with Wells Fargo Bank, National Association, NMF SLF merged with and into NMF Holdings on December 18, 2014. See “Management’s Discussion and Analysis of Financial Conditions and Results of Operations — Liquidity and Capital Resources — Borrowings” in the accompanying prospectus for additional information on our borrowings.

Current Organization

Our wholly-owned subsidiaries, NMF Ancora Holdings Inc. (“NMF Ancora”), NMF QID NGL Holdings, Inc. (“NMF QID”) and NMF YP Holdings Inc. (“NMF YP”), are structured as Delaware entities that serve as tax blocker corporations which hold equity or equity-like investments in portfolio companies organized as limited liability companies (or other forms of pass-through entities). We consolidate our tax blocker corporations for accounting purposes. The tax blocker corporations are not consolidated for income tax purposes and may incur income tax expense as a result of their ownership of the portfolio companies. Additionally, our wholly-owned subsidiary, New Mountain Finance Servicing, L.L.C. (“NMF Servicing”) serves as the administrative agent on certain investment transactions. SBIC LP, and its general partner, SBIC GP, were organized in Delaware as a limited partnership and limited liability company, respectively. SBIC LP and SBIC GP are our consolidated wholly-owned direct and indirect subsidiaries. SBIC LP received a license from the U.S. Small Business Administration (the “SBA”) to operate as a small business investment company (“SBIC”) under Section 301(c) of the Small Business Investment Act of 1958, as amended (the “1958 Act”).

(1) Includes amounts committed, not all of which have been drawn down and invested to-date, as of June 30, 2016, as well as amounts called and returned since inception.

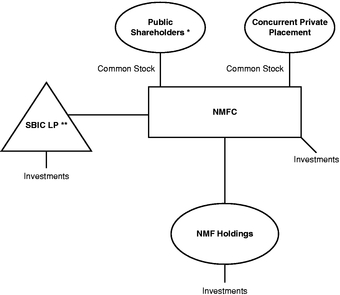

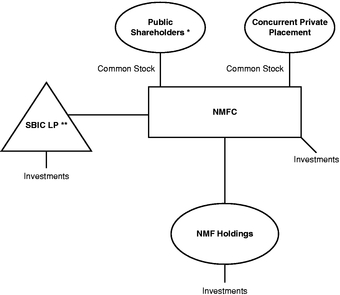

The diagram below depicts our organizational structure as of August 16, 2016.

* Includes partners of New Mountain Guardian Partners, L.P.

** NMFC is the sole limited partner of SBIC LP. NMFC, directly or indirectly through SBIC GP, wholly-owns SBIC LP. NMFC owns 100.0% of SBIC GP which owns 1.0% of SBIC LP. NMFC owns 99.0% of SBIC LP.

S-3

Our investment objective is to generate current income and capital appreciation through the sourcing and origination of debt securities at all levels of the capital structure, including first and second lien debt, notes, bonds and mezzanine securities. In some cases, our investments may also include equity interests. The primary focus is in the debt of defensive growth companies, which are defined as generally exhibiting the following characteristics: (i) sustainable secular growth drivers, (ii) high barriers to competitive entry, (iii) high free cash flow after capital expenditure and working capital needs, (iv) high returns on assets and (v) niche market dominance. Similar to us, SBIC LP’s investment objective is to generate current income and capital appreciation under our investment criteria. However, SBIC LP’s investments must be in SBA eligible companies. Our portfolio may be concentrated in a limited number of industries. As of June 30, 2016, our top five industry concentrations were business services, software, education, federal services and distribution & logistics.

The investments that we invest in are almost entirely rated below investment grade or may be unrated, which are often referred to as “leveraged loans”, “high yield” or “junk” debt investments, and may be considered “high risk” or speculative compared to debt investments that are rated investment grade. Such issuers are considered more likely than investment grade issuers to default on their payments of interest and principal and such risk of default could reduce our net asset value and income distributions. Our investments are also primarily floating rate debt investments that contain interest reset provisions that may make it more difficult for borrowers to make debt repayments to us if interest rates rise. In addition, some of our debt investments will not fully amortize during their lifetime, which could result in a loss or a substantial amount of unpaid principal and interest due upon maturity. Our debt investments may also lose significant market value before a default occurs. Furthermore, an active trading market may not exist for these securities. This illiquidity may make it more difficult to value our investments.

As of June 30, 2016, our net asset value was $843.3 million and our portfolio had a fair value of approximately $1,498.1 million in 72 portfolio companies, with a weighted average yield to maturity at cost (“Yield to Maturity at Cost”) of approximately 10.3%. This Yield to Maturity at Cost calculation assumes that all investments, including secured collateralized agreements, not on non-accrual are purchased at the adjusted cost on the quarter end date and held until their respective maturities with no prepayments or losses and exited at par at maturity. Adjusted cost reflects the accounting principles generally accepted in the United States of America (“GAAP”) cost for post-IPO investments and a stepped up cost basis of pre-IPO investments (assuming a step-up to fair market value occurred on the IPO date). This calculation excludes the impact of existing leverage. Yield to Maturity at Cost uses the London Interbank Offered Rate (“LIBOR”) curves at each quarter’s end date. The actual yield to maturity may be higher or lower due to the future selection of the LIBOR contracts by the individual companies in our portfolio or other factors.

Recent Developments

[Insert Recent Developments at the Time of the Offering]

The Investment Adviser

The Investment Adviser, a wholly-owned subsidiary of New Mountain Capital, manages our day-to-day operations and provides us with investment advisory and management services. In particular, the Investment Adviser is responsible for identifying attractive investment opportunities, conducting research and due diligence on prospective investments, structuring our investments and monitoring and servicing our investments. We currently do not have, and do not intend to have, any employees. As of June 30, 2016, the Investment Adviser was supported by approximately 100 staff members of New Mountain Capital, including approximately 60 investment professionals.

The Investment Adviser is managed by a five member investment committee (the “Investment Committee”), which is responsible for approving purchases and sales of our investments above $10.0 million in aggregate by issuer. The Investment Committee currently consists of Steven B. Klinsky, Robert A. Hamwee, Adam B. Weinstein and John R. Kline. The fifth and final member of the Investment Committee will consist of a New Mountain Capital Managing Director who will hold the position on the Investment Committee on an annual rotating basis. Beginning in August 2016, Mathew J. Lori

S-4

was appointed to the Investment Committee for a one year term. In addition, our executive officers and certain investment professionals of the Investment Adviser are invited to all Investment Committee meetings. Purchases and dispositions below $10.0 million may be approved by our Chief Executive Officer. These approval thresholds are subject to change over time. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on the Investment Committee, which includes expertise in private equity, primary and secondary leveraged credit, private mezzanine finance and distressed debt.

Competitive Advantages

We believe that we have the following competitive advantages over other capital providers to middle market companies:

Proven and Differentiated Investment Style With Areas of Deep Industry Knowledge

In making its investment decisions, the Investment Adviser applies New Mountain Capital’s long-standing, consistent investment approach that has been in place since its founding more than 15 years ago. We focus on companies in defensive growth niches of the middle market space where we believe few debt funds have built equivalent research and operational size and scale.

We benefit directly from New Mountain Capital’s private equity investment strategy that seeks to identify attractive investment sectors from the top down and then works to become a well positioned investor in these sectors. New Mountain Capital focuses on companies and industries with sustainable strengths in all economic cycles, particularly ones that are defensive in nature, that have secular tailwinds and can maintain pricing power in the midst of a recessionary and/or inflationary environment. New Mountain Capital focuses on companies within sectors in which it has significant expertise (examples include software, education, niche healthcare, business services, federal services and distribution & logistics) while typically avoiding investments in companies with products or services that serve markets that are highly cyclical, have the potential for long-term decline, are overly-dependent on consumer demand or are commodity-like in nature.

In making its investment decisions, the Investment Adviser has adopted the approach of New Mountain Capital, which is based on three primary investment principles:

1. A generalist approach, combined with proactive pursuit of the highest quality opportunities within carefully selected industries, identified via an intensive and structured ongoing research process;

2. Emphasis on strong downside protection and strict risk controls; and

3. Continued search for superior risk adjusted returns, combined with timely, intelligent exits and outstanding return performance.

Experienced Management Team and Established Platform

The Investment Adviser’s team members have extensive experience in the leveraged lending space. Steven B. Klinsky, New Mountain Capital’s Founder, Chief Executive Officer and Managing Director and Chairman of our board of directors, was a general partner of Forstmann Little & Co., a manager of debt and equity funds totaling multiple billions of dollars in the 1980s and 1990s. He was also a co-founder of Goldman, Sachs & Co.’s Leverage Buyout Group in the period from 1981 to 1984. Robert A. Hamwee, our Chief Executive Officer and Managing Director of New Mountain Capital, was formerly

S-5

President of GSC Group, Inc. (“GSC”), where he was the portfolio manager of GSC’s distressed debt funds and led the development of GSC’s CLOs. John R. Kline, our President and Chief Operating Officer and Managing Director of New Mountain Capital, worked at GSC as an investment analyst and trader for GSC’s control distressed and corporate credit funds and at Goldman, Sachs & Co. in the Credit Risk Management and Advisory Group.

Many of the debt investments that we have made to date have been in the same companies with which New Mountain Capital has already conducted months of intensive acquisition due diligence related to potential private equity investments. We believe that private equity underwriting due diligence is usually more robust than typical due diligence for loan underwriting. In its underwriting of debt investments, the Investment Adviser is able to utilize the research and hands-on operating experience that New Mountain Capital’s private equity underwriting teams possess regarding the individual companies and industries. Business and industry due diligence is led by a team of investment professionals of the Investment Adviser that generally consists of three to seven individuals, typically based on their relevant company and/or industry specific knowledge. Additionally, the Investment Adviser is also able to utilize its relationships with operating management teams and other private equity sponsors. We believe this differentiates us from many of our competitors.

Significant Sourcing Capabilities and Relationships

We believe the Investment Adviser’s ability to source attractive investment opportunities is greatly aided by both New Mountain Capital’s historical and current reviews of private equity opportunities in the business segments we target. To date, a significant majority of the investments that we have made are in the debt of companies and industry sectors that were first identified and reviewed in connection with New Mountain Capital’s private equity efforts, and the majority of our current pipeline reflects this as well. Furthermore, the Investment Adviser’s investment professionals have deep and longstanding relationships in both the private equity sponsor community and the lending/agency community which they have and will continue to utilize to generate investment opportunities.

Risk Management through Various Cycles

New Mountain Capital has emphasized tight control of risk since its inception and long before the recent global financial distress began. To date, New Mountain Capital has never experienced a bankruptcy of any of its portfolio companies in its private equity efforts. The Investment Adviser seeks to emphasize tight control of risk with our investments in several important ways, consistent with New Mountain Capital’s historical approach. In particular, the Investment Adviser:

· Emphasizes the origination or purchase of debt in what the Investment Adviser believes are defensive growth companies, which are less likely to be dependent on macro-economic cycles;

· Targets investments in companies that are preeminent market leaders in their own industries, and when possible, investments in companies that have strong management teams whose skills are difficult for competitors to acquire or reproduce; and

· Targets investments in companies with significant equity value in excess of our debt investments.

Access to Non Mark to Market, Seasoned Leverage Facility

The amount available under the Holdings Credit Facility is generally not subject to reduction as a result of mark to market fluctuations in our portfolio investments. None of our credit facilities mature prior to June 2019. For a detailed

S-6

discussion of our credit facilities, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations — Liquidity and Capital Resources” in the accompanying prospectus.

Market Opportunity

We believe that the size of the market for investments that we target, coupled with the demands of middle market companies for flexible sources of capital at competitive terms and rates, create an attractive investment environment for us.

· The leverage finance market has a high level of financing needs over the next several years due to significant bank debt maturities and significant amounts of private equity investable capital. We believe that the large dollar volume of loans that need to be refinanced will present attractive opportunities to invest capital in a manner consistent with our stated objectives.

· Middle market companies continue to face difficulties in accessing the capital markets. We believe opportunities to serve the middle market will continue to exist. While many middle market companies were formerly able to raise funds by issuing high-yield bonds, we believe this approach to financing has become more difficult in recent years as institutional investors have sought to invest in larger, more liquid offerings.

· Increased regulatory scrutiny of banks has reduced middle market lending. We believe that many traditional bank lenders to middle market businesses have either exited or de-emphasized their service and product offerings in the middle market. These traditional lenders have instead focused on lending and providing other services to large corporate clients. We believe this has resulted in fewer key players and the reduced availability of debt capital to the companies we target.

· Attractive pricing. Reduced access to, and availability of, debt capital typically increases the interest rates, or pricing, of loans for middle market lenders. Recent primary debt transactions in this market often include upfront fees, original issue discount, prepayment protections and, in some cases, warrants to purchase common stock, all of which should enhance the profitability of new loans to lenders.

· Conservative deal structures. As a result of the credit crisis, many lenders are requiring larger equity contributions from financial sponsors. Larger equity contributions create an enhanced margin of safety for lenders because leverage is a lower percentage of the implied enterprise value of the company.

· Large pool of uninvested private equity capital available for new buyouts. We expect that private equity firms will continue to pursue acquisitions and will seek to leverage their equity investments with mezzanine loans and/or senior loans (including traditional first and second lien, as well as unitranche loans) provided by companies such as ours.

Operating and Regulatory Structure

We are a closed-end, non-diversified management investment company that has elected to be regulated as a BDC under the 1940 Act and are required to maintain an asset coverage ratio, as defined in the 1940 Act, of at least 200.0%. We include the assets and liabilities of our consolidated subsidiaries for purposes of satisfying the requirements under the 1940 Act. See “Regulation — Senior Securities” in the accompanying prospectus..

We have elected to be treated, and intend to comply with the requirements to continue to qualify annually, as a RIC under Subchapter M of the Code. See “Material Federal Income Tax Considerations” in the accompanying prospectus. As a RIC, we generally will not be subject to corporate-level U.S. federal income taxes on any net ordinary income or capital gains that we timely distribute to our stockholders as dividends if it meets certain source-of-income, distribution and asset diversification requirements. We intend to distribute to our stockholders substantially all of our annual taxable income except that we may retain certain net capital gains for reinvestment.

S-7

Risks

An investment in our common stock involves risk, including the risk of leverage and the risk that our operating policies and strategies may change without prior notice to our stockholders or prior stockholder approval. See “Risk Factors” and the other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. The value of our assets, as well as the market price of our shares, will fluctuate. Our investments may be risky, and you may lose all or part of your investment. Investing in us involves other risks, including the following:

· We may suffer credit losses;

· We do not expect to replicate the Predecessor Entities’ nor our historical performance or the historical performance of other entities managed or supported by New Mountain Capital;

· There is uncertainty as to the value of our portfolio investments because most of our investments are, and may continue to be in private companies and recorded at fair value;

· Our ability to achieve our investment objective depends on key investment personnel of the Investment Adviser. If the Investment Adviser were to lose any of its key investment personnel, our ability to achieve our investment objective could be significantly harmed;

· The Investment Adviser has limited experience managing a BDC or a RIC, which could adversely affect our business;

· We operate in a highly competitive market for investment opportunities and may not be able to compete effectively;

· Our investments in securities rated below investment grade are speculative in nature and are subject to additional risk factors such as increased possibility of default, illiquidity of the security, and changes in value based on changes in interest rates;

· Our business, results of operations and financial condition depends on our ability to manage future growth effectively;

· We borrow money, which could magnify the potential for gain or loss on amounts invested in us and increase the risk of investing in us;

· Changes in interest rates may affect our cost of capital and net investment income;

· Regulations governing the operations of BDCs will affect our ability to raise additional equity capital as well as our ability to issue senior securities or borrow for investment purposes, any or all of which could have a negative effect on our investment objectives and strategies;

· We may experience fluctuations in our annual and quarterly results due to the nature of our business;

S-8

· Our board of directors may change our investment objective, operating policies and strategies without prior notice or stockholder approval, the effects of which may be adverse to your interests;

· We will be subject to corporate-level U.S. federal income tax on all of our income if we are unable to maintain RIC status under Subchapter M of the Code, which would have a material adverse effect on our financial performance;

· We may not be able to pay you distributions on our common stock, our distributions to you may not grow over time and a portion of our distributions to you may be a return of capital for U.S. federal income tax purposes;

· Our investments in portfolio companies may be risky, and we could lose all or part of any of our investments;

· The lack of liquidity in our investments may adversely affect our business;

· Economic recessions, downturns or government spending cuts could impair our portfolio companies and harm our operating results;

· The market price of our common stock may fluctuate significantly;

· Sales of substantial amounts of our common stock in the public market may have an adverse effect on the market price of our preferred stock;

· If we issue preferred stock, the net asset value and market value of our common stock will likely become more volatile; and

· Your interest in us may be diluted if you do not fully exercise your subscription rights in this offering.

· [Insert any additional risk factors applicable to rights offerings.]

Company Information

Our administrative and executive offices are located at 787 Seventh Avenue, 48th Floor, New York, New York 10019, and our telephone number is (212) 720-0300. We maintain a website at http://www.newmountainfinance.com. Information contained on our website is not incorporated by reference into this prospectus supplement and the accompanying prospectus, and you should not consider information contained on our website to be part of this prospectus supplement and the accompanying prospectus.

Presentation of Historical Financial Information and Market Data

Historical Financial Information

Unless otherwise indicated, historical references contained in the accompanying prospectus for periods prior to and as of December 31, 2013 in “Selected Financial and Other Data”, “Selected Quarterly Data”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Senior Securities” and “Portfolio Companies” relate to NMF Holdings. The consolidated financial statements of New Mountain Finance Holdings, L.L.C., formerly known as New Mountain Guardian (Leveraged), L.L.C., and New Mountain Guardian Partners, L.P. are NMF Holdings’ historical consolidated financial statements.

S-9

Market Data

Statistical and market data used in this prospectus supplement and the accompanying prospectus has been obtained from governmental and independent industry sources and publications. We have not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained in this prospectus supplement and the accompanying prospectus. See “Cautionary Statement Regarding Forward-Looking Statements”.

THE RIGHTS OFFERING

The Offer

We are issuing to stockholders of record, or record date stockholders, on , , or the record date, [ ] [transferable/non-transferable] right(s) for each share of our common stock held on the record date. Each holder of the rights, or rights holder, is entitled to subscribe for [ ] share(s) of our common stock for every rights held [ , which we refer to as the primary subscription right]. We will not issue fractional shares of our common stock upon the exercise of rights; accordingly, rights may be exercised only in multiples of .

[The rights are transferable and will be listed for trading on [ ] under the symbol “ “ during the course of this offer. See “The Offer.”]

Subscription Price

The subscription price per share will be [describe means of computing subscription price]. [Because the subscription price will be determined on the expiration date, rights holders who decide to acquire shares pursuant to the primary subscription right or pursuant to the over-subscription privilege will not know the actual purchase price of those shares when they make that decision.] See “The Offer—Subscription Price.”

[Over-Subscription Privilege

Record date stockholders who fully exercise all rights issued to them (other than those rights which cannot be exercised because they represent the right to acquire less than [ ] share(s)) are entitled to subscribe for additional shares of our common stock which were not subscribed for by other stockholders, which we refer to as the remaining shares. If sufficient remaining shares of our common stock are available, all record date stockholders’ over-subscription requests will be honored in full. In addition, any non-record date stockholder who exercises rights is entitled to subscribe for remaining shares that are not otherwise subscribed for by record date stockholders. Shares acquired pursuant to the over-subscription privilege are subject to certain limitations and pro-rata allocations. See “The Offer—Over-Subscription Privilege.”]

Purpose of the Offer

[Our Board of Directors has determined that it would be in the best interest of NMFC and its stockholders to increase the capital available for making additional investments, as well as to pay operating expenses, temporarily repay debt and generally enhance our liquidity. We believe that we must have sufficient liquidity available to remain a credible source of capital. This offering will increase the capital available for us to make additional investments.] This offering gives existing stockholders the right to purchase additional shares at a price that is expected to be below market without incurring any commission or charge, while providing us access to additional capital resources. In connection with the approval of this rights offering, our board of directors considered, among other things, the following factors:

S-10

· the subscription price relative to the market price and to our net asset value per share, including the likelihood that the subscription price will be below our net asset value per share;

· the increased capital to be available upon completion of this rights offering for us to make additional investments consistent with our investment objective;

· the dilution to be experienced by non-exercising stockholders;

· the dilutive effect the offering will have on the dividends per share we distribute subsequent to completion of the offering;

· [the terms and expenses in connection with the offering relative to other alternatives for raising capital, including fees payable to the dealer manager;]

· the size of the offering in relation to the number of shares outstanding;

· [the fact that the rights will be listed on [ ] during the subscription period;]

· the market price of our common stock, both before and after the announcement of the rights offering;

· the general condition of the securities markets; and

· any impact on operating expenses associated with an increase in capital, including an increase in fees payable to the Investment Adviser.

There can be no assurance of the amount of dilution that a stockholder will experience or that the rights offering will be successful.

[The purpose of setting the determination of the subscription price upon the expiration of the offer is to attract the maximum participation of stockholders in the offer, with minimum dilution to non-participating stockholders.]

[The transferable rights will allow non-participating stockholders the potential of receiving cash payment upon the sale of the rights, receipt of which may be viewed as partial compensation for the dilution of their interests.]

We cannot assure you that this offering will be successful, or that by increasing the amount of our available capital, our aggregate expenses and, correspondingly, our expense ratio will be lowered. In addition, the management fee we pay to the Investment Adviser is based upon our gross assets, which include any cash or cash equivalents that we have not yet invested in the securities of portfolio companies.

[In determining that this offer is in our best interest and in the best interests of our stockholders, we have retained , the dealer manager for this offer, to provide us with financial advisory, marketing and soliciting services relating to this offer, including advice with respect to the structure, timing and terms of the offer. In this regard, our board of directors considered, among other things, using a fixed pricing versus variable pricing mechanism, the benefits and drawbacks of conducting a non-transferable versus a transferable rights offering, the effect on us if this offer is not fully subscribed and the experience of the dealer manager in conducting rights offerings.]

[Although we have no present intention to do so, we may, in the future and in our discretion, choose to make additional rights offerings from time to time for a number of shares and on terms which may or may not be similar to this offer, provided that our Board of Directors must determine that each subsequent rights offering is in the best interest of our stockholders. Any such future rights offering will be made in accordance with the 1940 Act.]

[Sale of Rights

The rights are evidenced by a subscription certificate and are transferable until , (or if the offer is extended, until the extended expiration date). The rights will be listed for trading on [ ] under the symbol “ “. We and the dealer manager will use our best efforts to ensure that an adequate trading market for the rights will exist. However, no assurance can be

S-11

given that a market for the rights will develop. Trading in the rights on [ ] may be conducted until close of trading on [ ] on , (or, if the offer is extended, until the extended expiration date). See “The Offer—Sale of Rights.”]

Use of Proceeds

We intend to use the net proceeds from this offering for new investments in portfolio companies in accordance with our investment objective and strategies described in this prospectus supplement and the accompanying prospectus, to temporarily repay indebtedness (which will be subject to reborrowing), to pay our operating expenses, to pay distributions to our stockholders/unit holders and for general corporate purposes. See “Use of Proceeds.”

Amendments and Termination

We reserve the right to amend the terms and conditions of this offering, whether the amended terms are more or less favorable to you. We will comply with all applicable laws, including the federal securities laws, in connection with any such amendment. In addition, we may, in our sole discretion, terminate the rights offering at any time prior to delivery of the shares of our common stock offered hereby, if the subscription price is less than [ ]% of the net asset value attributable to a share of common stock disclosed in the most recent periodic report we filed with the SEC. If this rights offering is terminated, all rights will expire without value and the subscription agent will return as soon as practicable all exercise payments, without interest. [No amounts paid to acquire rights on [insert name of any applicable exchange on which rights are listed] or otherwise will be returned.]

Dilutive Effects

Any stockholder who chooses not to participate in the offering should expect to own a smaller interest in us upon completion of the offering. The offering will dilute the ownership interest and voting power of stockholders who do not fully exercise their basic subscription rights. Further, because the net proceeds per share from the offering may be lower than our net asset value per share, the offering may reduce our net asset value per share. The amount of dilution that a stockholder will experience could be substantial.

How to Obtain Subscription Information

· Contact your broker-dealer, trust company, bank or other nominee where your rights are held, or

· Contact the information agent, , at . Broker-dealers and nominees may call .

How to Subscribe

· Deliver a completed subscription certificate and payment to the subscription agent by the expiration date of the rights offering, or

· If your shares are held in an account with your broker-dealer, trust company, bank or other nominee, which qualifies as an Eligible Guarantor Institution under Rule 17Ad-15 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), have your Eligible Guarantor Institution deliver a notice of guaranteed delivery to the subscription agent by the expiration date of the rights offering.

S-12

Subscription Agent

will act as the subscription agent in connection with this offer.

Information Agent

will act as the information agent in connection with this offer. You may contact toll-free with questions at . Broker-dealers and nominees may call .

[Distribution Arrangements

will act as dealer manager for the offer. Under the terms and subject to the conditions contained in the dealer manager agreement, the dealer manager will provide financial advisory services and marketing assistance in connection with the offer and will solicit the exercise of rights and participation in the over-subscription privilege by our stockholders. The offer is not contingent upon any number of rights being exercised. We have agreed to pay the dealer manager a fee for its financial advisory, marketing and soliciting services equal to % of the subscription price per share for shares issued pursuant to the exercise of rights, including pursuant to the over-subscription privilege. The dealer manager may reallow a portion of its fees to other broker-dealers that have assisted in soliciting the exercise of rights.]

Important Dates to Remember

|

Record Date |

|

|

|

|

Subscription Period |

|

|

(1) |

|

Measurement Period for Subscription Price(2) |

|

|

(1) |

|

Expiration Date |

|

|

(1) |

|

Deadline for Delivery of Subscription Certificates and Payment for Shares(3) |

|

|

(1) |

|

Deadline for Delivery of Notice of Guaranteed Delivery(3) |

|

|

(1) |

|

Deadline for Delivery of Subscription Certificates and Payment for Shares pursuant to Notice of Guaranteed Delivery |

|

|

(1) |

|

Confirmations Mailed to Participants |

|

|

(1) |

|

Final Payment for Shares |

|

|

(1) |

(1) Unless the offer is extended.

(2) The subscription price will be [describe means of computing subscription price].

(3) Participating rights holders must, by the expiration date of the offer (unless the offer is extended), either (a) deliver a subscription certificate and payment for shares or (b) cause to be delivered on their behalf a notice of guaranteed delivery.

FEES AND EXPENSES

The following table is intended to assist you in understanding the costs and expenses that you will bear directly or indirectly. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus supplement and the accompanying prospectus contains a reference to fees or expenses paid by “you”, “NMFC”, or “us” or that “we”, “NMFC”, or the “Company” will pay fees or expenses, we will pay such fees and expenses out of our net assets and, consequently, you will indirectly bear such fees or expenses as an investor in us. However, you will not be required to deliver any money or otherwise bear personal liability or responsibility for such fees or expenses.

S-13

|

Stockholder transaction expenses: |

|

|

|

|

Sales load (as a percentage of offering price) |

|

|

%(1) |

|

Offering expenses borne by us (as a percentage of offering price) |

|

|

%(2) |

|

Dividend reinvestment plan fees |

|

|

(3) |

|

Total stockholder transaction expenses (as a percentage of offering price) |

|

|

% |

|

Annual expenses (as a percentage of net assets attributable to common stock): |

|

|

|

|

Base management fees |

|

|

%(4) |

|

Incentive fees payable under the Investment Management Agreement |

|

|

%(5) |

|

Interest payments on borrowed funds |

|

|

%(6) |

|

Other expenses |

|

|

%(7) |

|

Acquired fund fees and expenses |

|

|

%(8) |

|

Total annual expenses |

|

|

%(9) |

Example

The following example, required by the SEC, demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our common stock. In calculating the following expense amounts, we have assumed that our borrowings and annual operating expenses would remain at the levels set forth in the table above. See Note 6 below for additional information regarding certain assumptions regarding our level of leverage.

|

|

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

|

You would pay the following expenses on a $1,000 investment, assuming a 5.0% annual return |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The example and the expenses in the tables above should not be considered a representation of future expenses, and actual expenses may be greater or less than those shown.

While the example assumes, as required by the applicable rules of the SEC, a 5.0% annual return, our performance will vary and may result in a return greater or less than 5.0%. The incentive fee under the Investment Management Agreement, which, assuming a 5.0% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is not included in the above example. The above illustration assumes that we will not realize any capital gains (computed net of all realized capital losses and unrealized capital depreciation) in any of the indicated time periods. If we achieve sufficient returns on our investments, including through the realization of capital gains, to trigger an incentive fee of a material amount, our expenses and returns to our investors would be higher. For example, if we assumed that we received our 5.0% annual return completely in the form of net realized capital gains on our investments, computed net of all cumulative unrealized depreciation on our investments, the projected dollar amount of total cumulative expenses set forth in the above illustration would be as follows:

|

|

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

|

You would pay the following expenses on a $1,000 investment, assuming a 5.0% annual return |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The example assumes no sales load. In addition, while the examples assume reinvestment of all distributions at net asset value, participants in our dividend reinvestment plan will receive a number of shares of our common stock determined by dividing the total dollar amount of the distribution payable to a participant by the market price per share of our common stock at the close of trading on the dividend payment date. The market price per share of our common stock may be at, above or below net asset value. See “Dividend Reinvestment Plan” in the accompanying prospectus for additional information regarding the dividend reinvestment plan.

S-14

(1) NMFC has agreed to pay the dealer manager a fee for its financial advisory, marketing and soliciting services equal to [ ]% of the aggregate subscription price for the shares issued pursuant to the offer. See “The Offer — Distribution Arrangements.”

(2) Amount reflects estimated offering expenses of approximately $[ ], which assumes that the offer is fully subscribed. This amount excludes the fee that we have agreed to pay to the subscription agent, but includes reimbursement for its out-of-pocket expenses related to the offer, estimated to be $[ ]. See “The Offer — Distribution Arrangements.”

(3) The de minimis expenses of the dividend reinvestment plan are included in “other expenses.”

(4) The base management fee under the Investment Management Agreement is based on an annual rate of [ ]% of our average gross assets for the two most recent quarters, which equals our total assets on the Consolidated Statements of Assets and Liabilities, less (i) the borrowings under the SLF Credit Facility and (ii) cash and cash equivalents. We have not invested, and currently do not invest, in derivatives. To the extent we invest in derivatives in the future, we will use the actual value of the derivatives, as reported on our Consolidated Statements of Assets and Liabilities, for purposes of calculating our base management fee. Since our IPO, the base management fee calculation has deducted the borrowings under the SLF Credit Facility. The SLF Credit Facility had historically consisted of primarily lower yielding assets at higher advance rates. As part of an amendment to our existing credit facilities with Wells Fargo Bank, National Association, the SLF Credit Facility merged with the Predecessor Holdings Credit Facility and into the Holdings Credit Facility on December 18, 2014. Post credit facility merger and to be consistent with the methodology since our IPO, the Investment Adviser will continue to waive management fees on the leverage associated with those assets that share the same underlying yield characteristics with investments leveraged under the legacy SLF Credit Facility. The Investment Adviser cannot recoup management fees that the Investment Adviser has previously waived. The base management fee reflected in the table above is based on the six months ended [ ], 2016 and is calculated without deducting any management fees waived. The annual base management fee after deducting the management fee waiver as a percentage of net assets would be [ ]% based on the six months ended [ ], 2016. See “Investment Management Agreement” in the accompanying prospectus.

(5) Assumes that annual incentive fees earned by the Investment Adviser remain consistent with the incentive fees earned by the Investment Adviser during the six months ended [ ], 2016 and includes accrued capital gains incentive fee. These accrued capital gains incentive fees would be paid by us if we ceased operations on [ ], 2016 and liquidated our investments at the [ ], 2016 valuation. As we cannot predict whether we will meet the thresholds for incentive fees under the Investment Management Agreement, the incentive fees paid in subsequent periods, if any, may be substantially different than the fees incurred during the six months ended [ ], 2016. For more detailed information about the incentive fee calculations, see the “Investment Management Agreement” section of the accompanying prospectus.

(6) We may borrow funds from time to time to make investments to the extent we determine that additional capital would allow us to take advantage of additional investment opportunities or if the economic situation is otherwise conducive to doing so. The costs associated with these borrowings are indirectly borne by our stockholders. As of [ ], 2016, we had $[ ] million, $[ ] million, $[ ] million, $[ ] million and $[ ] million of indebtedness outstanding under the Holdings Credit Facility, the NMFC Credit Facility, the Convertible Notes, the Unsecured Notes and the SBA-guaranteed debentures, respectively. For purposes of this calculation, we have assumed the [ ], 2016 amounts outstanding under the credit facilities, Convertible Notes, Unsecured Notes and SBA-guaranteed debentures, and have computed interest expense using an assumed interest rate of [ ]% for the Holdings Credit Facility, [ ]% for the NMFC Credit Facility, [ ]% for the Convertible Notes, [ ]% for the Unsecured Notes and [ ]% for the SBA-guaranteed debentures, which were the rates payable as of [ ], 2016. See “Senior Securities” in the accompanying prospectus.

(7) “Other expenses” include our overhead expenses, including payments by us under the Administration Agreement based on the allocable portion of overhead and other expenses incurred by the Administrator in performing its obligations to us under the Administration Agreement. Pursuant to the Administration Agreement, the Administrator may, in its own discretion, submit to us for reimbursement some or all of the expenses that the Administrator has incurred on our behalf during any quarterly period. As a result, the amount of expenses for which we will have to reimburse the Administrator may fluctuate in future quarterly periods and there can be no assurance given as to when, or if, the Administrator may determine to limit the expenses that the Administrator submits to us for reimbursement in the future. However, it is expected that the Administrator will continue to support part of our expense burden in the near future and may decide to not calculate and charge through certain overhead related amounts as well as continue to cover some of the indirect costs. The Administrator cannot recoup any expenses that the Administrator has previously waived. This expense ratio is calculated without deducting any expenses waived or reimbursed by the Administrator. Assuming the expenses waived or reimbursed by the Administrator at [ ], 2016, the annual expense ratio after deducting the expenses waived or reimbursed by the Administrator as a percentage of net assets would be [ ]%. For the six months ended [ ], 2016, we reimbursed our Administrator approximately $[ ] million, which represents approximately [ ]% of our net assets on an annualized basis. See “Administration Agreement” in the accompanying prospectus.

(8) The holders of shares of our preferred stock indirectly bear the expenses of our investment in NMFC Senior Loan Program I, LLC (“SLP I”) and NMFC Senior Loan Program II, LLC (“SLP II”). No management fee is charged on our investment in SLP I in connection with the administrative services provided to SLP I. As SLP II is structured as a private joint venture, no management fees are paid by SLP II. Future expenses for SLP I and SLP II may be substantially higher or lower because certain expenses may fluctuate over time.

(9) The holders of shares of our common stock indirectly bear the cost associated with our annual expenses.

S-15

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about us, our current and prospective portfolio investments, our industry, our beliefs, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements. The forward-looking statements contained in this prospectus supplement involve risks and uncertainties, including statements as to:

· our future operating results;

· ours business prospects and the prospects of our portfolio companies;

· the impact of investments that we expect to make;

· our contractual arrangements and relationships with third parties;

· the dependence of our future success on the general economy and its impact on the industries in which we invest;

· the ability of our portfolio companies to achieve their objectives;

· our expected financings and investments;

· the adequacy of our cash resources and working capital; and

· the timing of cash flows, if any, from the operations of our portfolio companies.

These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

· an economic downturn could impair our portfolio companies’ ability to continue to operate, which could lead to the loss of some or all of our investments in such portfolio companies;

· a contraction of available credit and/or an inability to access the equity markets could impair our lending and investment activities;

· interest rate volatility could adversely affect our results, particularly if we elect to use leverage as part of our investment strategy;

· currency fluctuations could adversely affect the results of our investments in foreign companies, particularly to the extent that we receive payments denominated in foreign currency rather than U.S. dollars; and

· the risks, uncertainties and other factors we identify in “Risk Factors” and elsewhere in this prospectus supplement, the accompanying prospectus and in our filings with the SEC.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new loans and investments, certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus supplement should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in “Risk Factors” and elsewhere in this prospectus supplement and the accompanying prospectus. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this prospectus supplement. However, we will update this prospectus supplement to reflect any material changes to the information contained herein. The forward-looking statements and projections contained in this prospectus supplement are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, or the Securities Act.

S-16

SELECTED FINANCIAL AND OTHER DATA

The selected financial data should be read in conjunction with the respective financial statements and related consolidated notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus supplement. Financial information for the years ended December 31, 20 , December 31, 20 , December 31, 20 , December 31, 20 and December 31, 20 has been derived from our financial statements that were audited by [ ], an independent registered public accounting firm. The financial information at and for the [ ] months ended [ ], 20 was derived from our unaudited financial statements and related consolidated notes. In the opinion of management, all adjustments, consisting solely of normal recurring accruals, considered necessary for the fair presentation of financial statements for the interim periods, have been included. Our results for the interim periods may not be indicative of our results for any future interim period or the full year. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Senior Securities”, which are included elsewhere in this prospectus supplement and the accompanying in this prospectus, for more information.

[Insert Selected Financial and Other Data of New Mountain Finance Corporation reflecting most recently filed financials prior to the offering.]

RISK FACTORS

Investing in our securities involves a number of significant risks. Before you invest in our securities, you should be aware of various risks, including those described below and those set forth in the accompanying prospectus. You should carefully consider these risk factors, together with all of the other information included in this prospectus supplement and the accompanying prospectus, before you decide whether to make an investment in our securities. The risks set out below are not the only risks we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us may also impair our operations and performance. If any of the following events occur, our business, financial condition, results of operations and cash flows could be materially and adversely affected. In such case, our net asset value and the trading price of our common stock could decline, and you may lose all or part of your investment. The risk factors described below, together with those set forth in the accompanying prospectus, are the principal risk factors associated with an investment in us as well as those factors generally associated with an investment company with investment objectives, investment policies, capital structure or trading markets similar to ours.

Your interest in NMFC may be diluted if you do not fully exercise your subscription rights in this offering.

Stockholders who do not fully exercise their rights should expect that they will, at the completion of the offer, own a smaller proportional interest in NMFC than would otherwise be the case if they fully exercised their rights. We cannot state precisely the amount of any such dilution in share ownership because we do not know at this time what proportion of the shares will be purchased as a result of the offer.

In addition, if the subscription price is less than NMFC’s net asset value per share, then NMFC’s stockholders would experience an immediate dilution of the aggregate net asset value of their shares as a result of the offer. The amount of any decrease in net asset value is not predictable because it is not known at this time what the subscription price and net asset value per share will be on the expiration date of the rights offering or what proportion of the shares will be purchased as a result of the offer. Such dilution could be substantial.

[Insert risk factors applicable to the rights offering and any additional relevant risk factors not included in the base prospectus to the extent required to be disclosed by applicable law or regulation.]

CAPITALIZATION

The following table sets forth our capitalization as of [ ], 20[ ]:

S-17

· our actual capitalization at , 20 ; and

· our pro forma capitalization to give effect to the sale of shares of our common stock in this offering, assuming all rights are exercised at the estimated subscription price of $ and our receipt of the estimated net proceeds from that sale.

You should read this table together with “Use of Proceeds” and financial statements and related notes thereto included elsewhere in this prospectus supplement and the accompanying prospectus.

|

|

|

As of

[ ], 20[ ] |

|

|

|

|

Actual |

|

As Adjusted

(unaudited )(1) |

|

|

|

|

(in thousands) |

|

|

Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

$ |

|

|

|

Investments at fair value |

|

|

|

|

|

|

Other assets |

|

|

|

|

|

|

Total assets |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

Credit facilities payable |

|

$ |

|

|

$ |

|

|

|

Other liabilities |

|

|

|

|

|

|

Total liabilities |

|

$ |

|

|

$ |

|

|

|

Net assets |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, par value $0.01 per share; 100,000,000 shares authorized, shares outstanding |

|

|

|

$ |

|

|

|

Capital in excess of par value |

|

|

|

$ |

|

|

|

Total stockholders’ equity |

|

|

|

$ |

|

|

(1) We may change the size of this offering based on demand and market conditions. A $0.50 increase (decrease) in the assumed offering price per right would increase (decrease) net proceeds to us from this offering by $[ ] million, assuming the number of rights offered by us as set forth on the cover page of this prospectus supplement remains the same, after deducting the underwriting discount and estimated expenses payable by us. Any additional proceeds to us resulting from an increase in the public offering price or the number of rights offered pursuant to this prospectus supplement will increase our cash and cash equivalents on an as adjusted basis and will be used as described in “Use of Proceeds.”

USE OF PROCEEDS