Exhibit 99.7

[FORM OF PRELIMINARY PROSPECTUS SUPPLEMENT TO BE USED IN CONJUNCTION WITH FUTURE CONVERTIBLE NOTES OFFERINGS] (1)

Subject to Completion

Preliminary Prospectus Supplement dated [ ] , 20[ ]

$[ ]

New Mountain Finance Corporation

[ ]% Convertible Notes due 20[ ]

We are a Delaware corporation that was originally incorporated on June 29, 2010. We are a closed-end, non-diversified management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. Our investment objective is to generate current income and capital appreciation through the sourcing and origination of debt securities at all levels of the capital structure, including first and second lien debt, notes, bonds and mezzanine securities. In some cases, our investments may also include equity interests. Our primary focus is in the debt of defensive growth companies, which are defined as generally exhibiting the following characteristics: (i) sustainable secular growth drivers, (ii) high barriers to competitive entry, (iii) high free cash flow after capital expenditure and working capital needs, (iv) high returns on assets and (v) niche market dominance.

The investments that we invest in are almost entirely rated below investment grade or may be unrated, which are often referred to as “leveraged loans”, “high yield” or “junk” debt investments, and may be considered “high risk” or speculative compared to debt investments that are rated investment grade. Such issuers are considered more likely than investment grade issuers to default on their payments of interest and principal and such risk of default could reduce our net asset value and income distributions. Our investments are also primarily floating rate debt investments that contain interest reset provisions that may make it more difficult for borrowers to make debt repayments to us if interest rates rise. In addition, some of our debt investments will not fully amortize during their lifetime, which could result in a loss or a substantial amount of unpaid principal and interest due upon maturity. Our debt investments may also lose significant market value before a default occurs. Furthermore, an active trading market may not exist for these securities. This illiquidity may make it more difficult to value our investments.

We are offering $[ ] million aggregate principal amount of our [ ]% Convertible Notes due 20[ ] (the “Convertible Notes”). The Convertible Notes will bear interest at a rate of [ ]% per year, payable on [ ] and [ ] of each year, commencing on [ ]. The Convertible Notes will mature on [ ]. We may not redeem the Convertible Notes prior to maturity.

The Convertible Notes will be convertible, at your option, into shares of our common stock initially at a conversion rate of [ ] shares per $1,000 principal amount of Convertible Notes (equivalent to an initial conversion price of approximately $[ ] per share), subject to adjustment as described in this prospectus supplement, at any time on or prior to the close of business on the business day immediately preceding the maturity date. In the case of Convertible Notes that are converted in connection with certain types of fundamental changes, we will, in certain circumstances, increase the conversion rate by a number of additional shares.

You may require us to repurchase all or a portion of your Convertible Notes upon a fundamental change at a cash repurchase price equal to [ ]% of the principal amount plus accrued and unpaid interest (including additional interest, if any) through, and including, the maturity date. See “Description of the Notes — Fundamental Change Put”.

The Convertible Notes will be our unsecured obligations. As of [ ], 20[ ], we had $[ ] million of indebtedness outstanding, $[ ] million of which was secured indebtedness and $[ ] million of which was unsecured indebtedness. The Convertible Notes will be our direct unsecured obligations and rank pari passu, or equally in right of payment, with all outstanding and future unsecured, unsubordinated indebtedness issued by us.

There is no public market for the Convertible Notes, and we do not intend to apply for listing of the Convertible Notes on any securities exchange or for inclusion of the Convertible Notes in any automated quotation system. Our common stock is listed on the New York Stock Exchange under the symbol “NMFC”. On [ ], 20[ ], the last reported sales price on the New York Stock Exchange for our common stock was $[ ] per share, and the net asset value per share of our common stock on [ ], 20[ ] (the last date prior to the date of this prospectus supplement on which we determined our net asset value per share) was $[ ].

The price at issuance of the Convertible Notes will be [ ]% of the principal amount, plus accrued interest from [ ], 20[ ].

An investment in the Convertible Notes involves risks that are described in the “Supplementary Risk Factors” section beginning on page [ ] in this prospectus supplement and the “Risk Factors” section beginning on page [ ] of the accompanying prospectus.

This prospectus supplement and the accompanying prospectus contain important information about us that a prospective investor should know before investing in the Convertible Notes. Please read this prospectus supplement and the accompanying prospectus before investing and keep it for future reference. We file annual, quarterly and current reports, proxy statements and other information with the United States Securities and Exchange Commission (http://www.sec.gov), which is available free of charge by contacting us by mail at 787 Seventh Avenue, 48th Floor, New York, New York 10019 or on our website at http://www.newmountainfinance.com. Information contained on our website is not incorporated by reference into this prospectus supplement and the accompanying prospectus, and you should not consider that information to be part of this prospectus supplement and the accompanying prospectus.

(1) In addition to the information provided in this form of prospectus supplement, each prospectus supplement actually used in connection with an offering conducted pursuant to the registration statement to which this form of prospectus supplement is attached will be updated to include such other information as may then be required to be disclosed therein pursuant to applicable law or regulation as in effect as of the date of each such prospectus supplement, including, without limitation, additional information particular to the terms of each security offered thereby and any additional related risk factors or tax considerations pertaining thereto. The terms of the Notes or the provisions of the indenture governing the Notes may differ from the information provided in this form of prospectus supplement. This form of prospectus supplement is intended only to provide a rough approximation of the nature and type of disclosure that may appear in any actual prospectus supplement used for the purposes of offering securities pursuant to the registration statement to which this form of prospectus supplement is attached and, accordingly, the terms and description of the retail notes for which this form of prospectus supplement is to be used may differ from the information provided in this form of prospectus supplement. This form of prospectus supplement is not intended to and does not contain all of the information that would appear is any such actual prospectus supplement, and should not be used or relied upon in connection with any offer or sale of securities.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Note |

|

Total |

|

|

Public Offering Price |

|

[ ] |

% |

$ |

[ ] |

|

|

Sales Load paid by us (Underwriting Discounts and Commissions)(1) |

|

[ ] |

% |

$ |

[ ] |

|

|

Proceeds to us (before expenses)(2) |

|

[ ] |

% |

$ |

[ ] |

|

(1) See “Underwriting” for details of compensation to be received by the underwriters.

(2) All expenses of the offering will be borne by us. We will incur approximately $[ ] million of estimated expenses in connection with this offering.

We have granted the underwriters an option to purchase up to an additional $[ ] aggregate principal amount of Convertible Notes on the same terms and conditions as set forth above, exercisable within [ ] days from the date of this prospectus supplement. If the underwriters exercise this option in full, the total public offering price will be $[ ], plus accrued interest from [ ], 20[ ], the total sales load (discounts and commissions) paid by us will be $[ ], and total proceeds, before expenses, will be $[ ].

THE CONVERTIBLE NOTES ARE NOT DEPOSITS OR OTHER OBLIGATIONS OF A BANK AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY.

Delivery of the Convertible Notes in book-entry form only through The Depository Trust Company will be made on or about [ ], 20[ ].

Joint-Lead Bookrunners

[Underwriters]

Prospectus Supplement dated [ ], 20[ ]

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

|

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT |

S-ii |

|

PROSPECTUS SUPPLEMENT SUMMARY |

S-1 |

|

SPECIFIC TERMS OF THE NOTES AND THE OFFERING |

S-10 |

|

FEES AND EXPENSES |

S-15 |

|

SELECTED FINANCIAL AND OTHER DATA |

S-17 |

|

SELECTED QUARTERLY FINANCIAL DATA |

S-17 |

|

SUPPLEMENTARY RISK FACTORS |

S-17 |

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

S-24 |

|

CAPITALIZATION |

S-25 |

|

USE OF PROCEEDS |

S-26 |

|

PRICE RANGE OF COMMON STOCK AND DISTRIBUTIONS |

S-27 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

S-30 |

|

RATIOS OF EARNINGS TO FIXED CHARGES |

S-31 |

|

DESCRIPTION OF THE NOTES |

S-31 |

|

ADDITIONAL MATERIAL FEDERAL INCOME TAX CONSIDERATIONS |

S-50 |

|

UNDERWRITING |

S-51 |

|

LEGAL MATTERS |

S-54 |

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

S-54 |

|

AVAILABLE INFORMATION |

S-55 |

|

INDEX TO FINANCIAL STATEMENTS |

S-55 |

PROSPECTUS

[Insert table of contents from base prospectus]

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. Neither we nor the underwriters have authorized any other person to provide you with different information from that contained in this prospectus supplement or the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to buy, these securities by any person in any jurisdiction where it is unlawful for that person to make such an offer or solicitation or to any person in any jurisdiction to whom it is unlawful to make such an offer or solicitation. The information contained in this prospectus supplement and the accompanying prospectus is complete and accurate only as of their respective dates, regardless of the time of their delivery or sale of these securities. This prospectus supplement supersedes the accompanying prospectus to the extent it contains information different from or additional to the information in that prospectus.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from the information contained in the accompanying prospectus, the information in this prospectus supplement shall control. Please carefully read this prospectus supplement and the accompanying prospectus together with any exhibits and the additional information described under “Available Information”, “Prospectus Supplement Summary” and “Supplementary Risk Factors” in this prospectus supplement and the “Available Information”, “Summary” and “Risk Factors” sections of the accompanying prospectus before you make an investment decision. Unless otherwise indicated, all information included in this prospectus supplement assumes no exercise by the underwriters of their option to purchase up to an additional $[ ] aggregate principal amount of Convertible Notes.

The figures in this prospectus supplement relating to the conversion rate of the Convertible Notes have been updated to give effect to the $[ ] per share special dividend that was declared in the fiscal year ended December 31, 20[ ]; however, please refer to the indenture governing the Convertible Notes for the exact terms relating to the conversion rate of the Convertible Notes.

S-ii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights some of the information in this prospectus supplement and the accompanying prospectus. It may not contain all the information that is important to you. For a more complete understanding, we encourage you to read this entire prospectus supplement and the accompanying prospectus and the documents to which we have referred in this prospectus supplement, together with the accompanying prospectus, including the risks set forth under “Supplementary Risk Factors” in this prospectus supplement and “Risk Factors” in the accompanying prospectus, and the other information included in this prospectus supplement and the accompanying prospectus.

In this prospectus supplement, unless the context otherwise requires, references to:

· “NMFC”, the “Company”, “we”, “us” and “our” refers to New Mountain Finance Corporation, a Delaware corporation, which was incorporated on June 29, 2010, including, where appropriate, its wholly-owned direct and indirect subsidiaries;

· “NMF Holdings” and “Predecessor Operating Company” refers to New Mountain Finance Holdings, L.L.C., a Delaware limited liability company. References to NMF Holdings include its wholly-owned subsidiary, NMF SLF, unless the context otherwise requires. References to NMF Holdings exclude NMF SLF when referencing NMF Holdings’ common membership units, board of directors, and credit facility or leverage;

· “NMF SLF” refers to New Mountain Finance SPV Funding, L.L.C., a Delaware limited liability company;

· “SBIC GP” refers to New Mountain Finance SBIC G.P. L.L.C., a Delaware limited liability company;

· “SBIC LP” refers to New Mountain Finance SBIC L.P., a Delaware limited partnership;

· “Guardian AIV” refers to New Mountain Guardian AIV, L.P.;

· “AIV Holdings” refers to New Mountain Finance AIV Holdings Corporation, a Delaware corporation which was incorporated on March 11, 2011, of which Guardian AIV was the sole stockholder;

· “Investment Adviser” refers to New Mountain Finance Advisers BDC, L.L.C., our investment adviser;

· “Administrator” refers to New Mountain Finance Administration, L.L.C., our administrator;

· “New Mountain Capital” refers to New Mountain Capital Group, L.L.C. and its affiliates;

· “Predecessor Entities” refers to New Mountain Guardian (Leveraged), L.L.C. and New Mountain Guardian Partners, L.P., together with their respective direct and indirect wholly-owned subsidiaries prior to our initial public offering;

· “NMFC Credit Facility” refers to our Senior Secured Revolving Credit Agreement with Goldman Sachs Bank USA, Morgan Stanley Bank, N.A. and Stifel Bank & Trust, dated June 4, 2014, as amended (together with the related guarantee and security agreement);

· “Holdings Credit Facility” refers to NMF Holdings’ Second Amended and Restated Loan and Security Agreement with Wells Fargo Bank, National Association, dated December 18, 2014;

· “Predecessor Holdings Credit Facility” refers to NMF Holdings’ Amended and Restated Loan and Security Agreement with Wells Fargo Bank, National Association, dated May 19, 2011, as amended;

· “SLF Credit Facility” refers to NMF SLF’s Loan and Security Agreement with Wells Fargo Bank, National Association, dated October 27, 2010, as amended;

· “Convertible Notes” refers to our 5.00% convertible notes due 2019 issued on June 3, 2014 and September 30, 2016 under an indenture dated June 3, 2014 (the “Indenture”), between us and U.S. Bank National Association, as trustee; and

· “Unsecured Notes” refers to our unsecured notes issued on May 6, 2016 and September 30, 2016 under an amended and restated note purchase agreement, dated September 30, 2016, to institutional investors in a private placement.

For the periods prior to and as of December 31, 2013, all financial information provided in this prospectus supplement and accompanying prospectus reflect our organizational structure prior to the restructuring on May 8, 2014 described under “Description of Restructuring” in the accompanying prospectus, where NMF Holdings functioned as the operating company.

S-1

Overview

New Mountain Finance Corporation

We are a Delaware corporation that was originally incorporated on June 29, 2010. We are a closed-end, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). As such, we are obligated to comply with certain regulatory requirements. We have elected to be treated, and intend to comply with the requirements to continue to qualify annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended, (the “Code”). We are also registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

On May 19, 2011, we priced our initial public offering (the “IPO”) of 7,272,727 shares of common stock at a public offering price of $13.75 per share. Concurrently with the closing of the IPO and at the public offering price of $13.75 per share, we sold an additional 2,172,000 shares of our common stock to certain executives and employees of, and other individuals affiliated with, New Mountain Capital in a concurrent private placement (the “Concurrent Private Placement”). Additionally, 1,252,964 shares were issued to the partners of New Mountain Guardian Partners, L.P. at that time for their ownership interest in the Predecessor Entities. In connection with our IPO and through a series of transactions, NMF Holdings acquired all of the operations of the Predecessor Entities, including all of the assets and liabilities related to such operations.

New Mountain Finance Holdings, L.L.C.

NMF Holdings is a Delaware limited liability company. Until May 8, 2014, NMF Holdings was externally managed and was regulated as a BDC under the 1940 Act. As such, NMF Holdings was obligated to comply with certain regulatory requirements. NMF Holdings was treated as a partnership for United States (“U.S.”) federal income tax purposes for so long as it had at least two members. With the completion of the underwritten secondary offering on February 3, 2014, NMF Holdings’ existence as a partnership for U.S. federal income tax purposes terminated and NMF Holdings became an entity that is disregarded as a separate entity from its owner for U.S. federal tax purposes. See “Material Federal Income Tax Considerations” in the accompanying prospectus. For additional information on our organizational structure prior to May 8, 2014, see “Description of Restructuring” in the accompanying prospectus.

Until May 8, 2014, NMF Holdings was externally managed by the Investment Adviser. As of May 8, 2014, the Investment Adviser serves as our external investment adviser. The Administrator provides the administrative services necessary for operations. The Investment Adviser and Administrator are wholly-owned subsidiaries of New Mountain Capital. New Mountain Capital is a firm with a track record of investing in the middle market and with assets under management totaling more than $15.0 billion(1), which includes total assets held by us. New Mountain Capital focuses on investing in defensive growth companies across its private equity, public equity, and credit investment vehicles. NMF Holdings, formerly known as New Mountain Guardian (Leveraged), L.L.C., was originally formed as a subsidiary of Guardian AIV by New Mountain Capital in October 2008. Guardian AIV was formed through an allocation of approximately $300.0 million of the $5.1 billion of commitments supporting New Mountain Partners III, L.P., a private equity fund managed by New Mountain Capital. In February 2009, New Mountain Capital formed a co-investment vehicle, New Mountain Guardian Partners, L.P., comprising $20.4 million of commitments.

Prior to December 18, 2014, NMF SLF was a Delaware limited liability company. NMF SLF was a wholly-owned subsidiary of NMF Holdings and thus a wholly-owned indirect subsidiary of us. NMF SLF was bankruptcy-remote and non-recourse to us. As part of an amendment to our existing credit facilities with Wells Fargo Bank, National Association, NMF SLF merged with and into NMF Holdings on December 18, 2014. See “Management’s Discussion and Analysis of Financial Conditions and Results of Operations — Liquidity and Capital Resources — Borrowings” in this prospectus supplement for additional information on our borrowings.

(1) Includes amounts committed, not all of which have been drawn down and invested to-date, as of [ ], 20[ ], as well as amounts called and returned since inception.

S-2

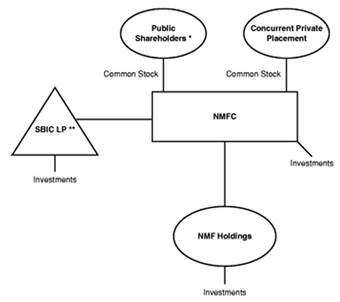

Current Organization

Our wholly-owned subsidiaries, NMF Ancora Holdings Inc. (“NMF Ancora”), NMF QID NGL Holdings, Inc. (“NMF QID”) and NMF YP Holdings Inc. (“NMF YP”), are structured as Delaware entities that serve as tax blocker corporations which hold equity or equity-like investments in portfolio companies organized as limited liability companies (or other forms of pass-through entities). We consolidate our tax blocker corporations for accounting purposes. The tax blocker corporations are not consolidated for income tax purposes and may incur income tax expense as a result of their ownership of the portfolio companies. Additionally, our wholly-owned subsidiary, New Mountain Finance Servicing, L.L.C. (“NMF Servicing”) serves as the administrative agent on certain investment transactions. SBIC LP, and its general partner, SBIC GP, were organized in Delaware as a limited partnership and limited liability company, respectively. SBIC LP and SBIC GP are our consolidated wholly-owned direct and indirect subsidiaries. SBIC LP received a license from the U.S. Small Business Administration (the “SBA”) to operate as a small business investment company (“SBIC”) under Section 301(c) of the Small Business Investment Act of 1958, as amended (the “1958 Act”).

The diagram below depicts our organizational structure as of [ ], 20[ ].

* Includes partners of New Mountain Guardian Partners, L.P.

** NMFC is the sole limited partner of SBIC LP. NMFC, directly or indirectly through SBIC GP, wholly-owns SBIC LP. NMFC owns 100.0% of SBIC GP which owns 1.0% of SBIC LP. NMFC owns 99.0% of SBIC LP.

Our investment objective is to generate current income and capital appreciation through the sourcing and origination of debt securities at all levels of the capital structure, including first and second lien debt, notes, bonds and mezzanine securities. In some cases, our investments may also include equity interests. The primary focus is in the debt of defensive growth companies, which are defined as generally exhibiting the following characteristics: (i) sustainable secular growth drivers, (ii) high barriers to competitive entry, (iii) high free cash flow after capital expenditure and working capital needs, (iv) high returns on assets and (v) niche market dominance. Similar to us, SBIC LP’s investment objective is to generate current income and capital appreciation under our investment criteria. However, SBIC LP’s investments must be in SBA eligible companies. Our portfolio may be concentrated in a limited number of industries. As of June 30, 2016, our top five industry concentrations were [business services, software, education, federal services and distribution & logistics].

S-3

The investments that we invest in are almost entirely rated below investment grade or may be unrated, which are often referred to as “leveraged loans”, “high yield” or “junk” debt investments, and may be considered “high risk” or speculative compared to debt investments that are rated investment grade. Such issuers are considered more likely than investment grade issuers to default on their payments of interest and principal and such risk of default could reduce our net asset value and income distributions. Our investments are also primarily floating rate debt investments that contain interest reset provisions that may make it more difficult for borrowers to make debt repayments to us if interest rates rise. In addition, some of our debt investments will not fully amortize during their lifetime, which could result in a loss or a substantial amount of unpaid principal and interest due upon maturity. Our debt investments may also lose significant market value before a default occurs. Furthermore, an active trading market may not exist for these securities. This illiquidity may make it more difficult to value our investments.

As of June 30, 2016, our net asset value was $843.3 million and our portfolio had a fair value of approximately $1,498.1 million in 72 portfolio companies, with a weighted average yield to maturity at cost (“Yield to Maturity at Cost”) of approximately 10.3%. This Yield to Maturity at Cost calculation assumes that all investments, including secured collateralized agreements, not on non-accrual are purchased at the adjusted cost on the quarter end date and held until their respective maturities with no prepayments or losses and exited at par at maturity. Adjusted cost reflects the accounting principles generally accepted in the United States of America (“GAAP”) cost for post-IPO investments and a stepped up cost basis of pre-IPO investments (assuming a step-up to fair market value occurred on the IPO date). This calculation excludes the impact of existing leverage. Yield to Maturity at Cost uses the London Interbank Offered Rate (“LIBOR”) curves at each quarter’s end date. The actual yield to maturity may be higher or lower due to the future selection of the LIBOR contracts by the individual companies in our portfolio or other factors.

Recent Developments

[Insert Recent Developments at the time of the offering]

The Investment Adviser

The Investment Adviser, a wholly-owned subsidiary of New Mountain Capital, manages our day-to-day operations and provides us with investment advisory and management services. In particular, the Investment Adviser is responsible for identifying attractive investment opportunities, conducting research and due diligence on prospective investments, structuring our investments and monitoring and servicing our investments. We currently do not have, and do not intend to have, any employees. As of June 30, 2016, the Investment Adviser was supported by approximately 100 staff members of New Mountain Capital, including approximately 60 investment professionals.

The Investment Adviser is managed by a five member investment committee (the “Investment Committee”), which is responsible for approving purchases and sales of our investments above $10.0 million in aggregate by issuer. The Investment Committee currently consists of Steven B. Klinsky, Robert A. Hamwee, Adam B. Weinstein and John R. Kline. The fifth and final member of the Investment Committee will consist of a New Mountain Capital Managing Director who will hold the position on the Investment Committee on an annual rotating basis. Beginning in August 2016, Matthew J. Lori was appointed to the Investment Committee for a one year term. In addition, our executive officers and certain investment professionals of the Investment Adviser are invited to all Investment Committee meetings. Purchases and dispositions below $10.0 million may be approved by our Chief Executive Officer. These approval thresholds are subject to change over time. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on the Investment Committee, which includes expertise in private equity, primary and secondary leveraged credit, private mezzanine finance and distressed debt.

Competitive Advantages

We believe that we have the following competitive advantages over other capital providers to middle market companies:

S-4

Proven and Differentiated Investment Style With Areas of Deep Industry Knowledge

In making its investment decisions, the Investment Adviser applies New Mountain Capital’s long-standing, consistent investment approach that has been in place since its founding more than 15 years ago. We focus on companies in defensive growth niches of the middle market space where we believe few debt funds have built equivalent research and operational size and scale.

We benefit directly from New Mountain Capital’s private equity investment strategy that seeks to identify attractive investment sectors from the top down and then works to become a well positioned investor in these sectors. New Mountain Capital focuses on companies and industries with sustainable strengths in all economic cycles, particularly ones that are defensive in nature, that have secular tailwinds and can maintain pricing power in the midst of a recessionary and/or inflationary environment. New Mountain Capital focuses on companies within sectors in which it has significant expertise (examples include software, education, niche healthcare, business services, federal services and distribution & logistics) while typically avoiding investments in companies with products or services that serve markets that are highly cyclical, have the potential for long-term decline, are overly-dependent on consumer demand or are commodity-like in nature.

In making its investment decisions, the Investment Adviser has adopted the approach of New Mountain Capital, which is based on three primary investment principles:

1. A generalist approach, combined with proactive pursuit of the highest quality opportunities within carefully selected industries, identified via an intensive and structured ongoing research process;

2. Emphasis on strong downside protection and strict risk controls; and

3. Continued search for superior risk adjusted returns, combined with timely, intelligent exits and outstanding return performance.

Experienced Management Team and Established Platform

The Investment Adviser’s team members have extensive experience in the leveraged lending space. Steven B. Klinsky, New Mountain Capital’s Founder, Chief Executive Officer and Managing Director and Chairman of our board of directors, was a general partner of Forstmann Little & Co., a manager of debt and equity funds totaling multiple billions of dollars in the 1980s and 1990s. He was also a co-founder of Goldman, Sachs & Co.’s Leverage Buyout Group in the period from 1981 to 1984. Robert A. Hamwee, our Chief Executive Officer and Managing Director of New Mountain Capital, was formerly President of GSC Group, Inc. (“GSC”), where he was the portfolio manager of GSC’s distressed debt funds and led the development of GSC’s CLOs. John R. Kline, our President and Chief Operating Officer and Managing Director of New Mountain Capital, worked at GSC as an investment analyst and trader for GSC’s control distressed and corporate credit funds and at Goldman, Sachs & Co. in the Credit Risk Management and Advisory Group.

Many of the debt investments that we have made to date have been in the same companies with which New Mountain Capital has already conducted months of intensive acquisition due diligence related to potential private equity investments. We believe that private equity underwriting due diligence is usually more robust than typical due diligence for loan underwriting. In its underwriting of debt investments, the Investment Adviser is able to utilize the research and hands-on operating experience that New Mountain Capital’s private equity underwriting teams possess regarding the individual companies and industries. Business and industry due diligence is led by a team of investment professionals of the Investment Adviser that generally consists of three to seven individuals, typically based on their relevant company and/or industry specific knowledge. Additionally, the Investment Adviser is also able to utilize its relationships with operating management teams and other private equity sponsors. We believe this differentiates us from many of our competitors.

Significant Sourcing Capabilities and Relationships

We believe the Investment Adviser’s ability to source attractive investment opportunities is greatly aided by both New Mountain Capital’s historical and current reviews of private equity opportunities in the business segments

S-5

we target. To date, a significant majority of the investments that we have made are in the debt of companies and industry sectors that were first identified and reviewed in connection with New Mountain Capital’s private equity efforts, and the majority of our current pipeline reflects this as well. Furthermore, the Investment Adviser’s investment professionals have deep and longstanding relationships in both the private equity sponsor community and the lending/agency community which they have and will continue to utilize to generate investment opportunities.

Risk Management through Various Cycles

New Mountain Capital has emphasized tight control of risk since its inception and long before the recent global financial distress began. To date, New Mountain Capital has never experienced a bankruptcy of any of its portfolio companies in its private equity efforts. The Investment Adviser seeks to emphasize tight control of risk with our investments in several important ways, consistent with New Mountain Capital’s historical approach. In particular, the Investment Adviser:

· Emphasizes the origination or purchase of debt in what the Investment Adviser believes are defensive growth companies, which are less likely to be dependent on macro-economic cycles;

· Targets investments in companies that are preeminent market leaders in their own industries, and when possible, investments in companies that have strong management teams whose skills are difficult for competitors to acquire or reproduce; and

· Targets investments in companies with significant equity value in excess of our debt investments.

Access to Non Mark to Market, Seasoned Leverage Facility

The amount available under the Holdings Credit Facility is generally not subject to reduction as a result of mark to market fluctuations in our portfolio investments. None of our credit facilities mature prior to June 2019. For a detailed discussion of our credit facilities, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations — Liquidity and Capital Resources” in this prospectus supplement.

Market Opportunity

We believe that the size of the market for investments that we target, coupled with the demands of middle market companies for flexible sources of capital at competitive terms and rates, create an attractive investment environment for us.

· The leverage finance market has a high level of financing needs over the next several years due to significant bank debt maturities and significant amounts of private equity investable capital. We believe that the large dollar volume of loans that need to be refinanced will present attractive opportunities to invest capital in a manner consistent with our stated objectives.

· Middle market companies continue to face difficulties in accessing the capital markets. We believe opportunities to serve the middle market will continue to exist. While many middle market companies were formerly able to raise funds by issuing high-yield bonds, we believe this approach to financing has become more difficult in recent years as institutional investors have sought to invest in larger, more liquid offerings.

· Increased regulatory scrutiny of banks has reduced middle market lending. We believe that many traditional bank lenders to middle market businesses have either exited or de-emphasized their service and product offerings in the middle market. These traditional lenders have instead focused on lending and providing other services to large corporate clients. We believe this has resulted in fewer key players and the reduced availability of debt capital to the companies we target.

S-6

· Attractive pricing. Reduced access to, and availability of, debt capital typically increases the interest rates, or pricing, of loans for middle market lenders. Recent primary debt transactions in this market often include upfront fees, original issue discount, prepayment protections and, in some cases, warrants to purchase common stock, all of which should enhance the profitability of new loans to lenders.

· Conservative deal structures. As a result of the credit crisis, many lenders are requiring larger equity contributions from financial sponsors. Larger equity contributions create an enhanced margin of safety for lenders because leverage is a lower percentage of the implied enterprise value of the company.

· Large pool of uninvested private equity capital available for new buyouts. We expect that private equity firms will continue to pursue acquisitions and will seek to leverage their equity investments with mezzanine loans and/or senior loans (including traditional first and second lien, as well as unitranche loans) provided by companies such as ours.

Operating and Regulatory Structure

We are a closed-end, non-diversified management investment company that has elected to be regulated as a BDC under the 1940 Act and are required to maintain an asset coverage ratio, as defined in the 1940 Act, of at least 200.0%. We include the assets and liabilities of our consolidated subsidiaries for purposes of satisfying the requirements under the 1940 Act. See “Regulation” in the accompanying prospectus.

We have elected to be treated, and intend to comply with the requirements to continue to qualify annually, as a RIC under Subchapter M of the Code. See “Material Federal Income Tax Considerations” in the accompanying prospectus. As a RIC, we generally will not be subject to corporate-level U.S. federal income taxes on any net ordinary income or capital gains that we timely distribute to our stockholders as dividends if it meets certain source-of-income, distribution and asset diversification requirements. We intend to distribute to our stockholders substantially all of our annual taxable income except that we may retain certain net capital gains for reinvestment.

Risks

An investment in the Convertible Notes involves risk, including the risk of leverage and the risk that our operating policies and strategies may change without prior notice. See “Supplementary Risk Factors” in this prospectus supplement and “Risk Factors” in the accompanying prospectus, and the other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in the Convertible Notes. The value of our assets, as well as the market price of our securities, will fluctuate. Our investments may be risky, and you may lose all or part of your investment. Investing in us involves other risks, including the following:

· Our amount of debt outstanding will increase as a result of this offering, which could adversely affect our business, financial condition and results of operations and our ability to meet our payment obligations under the Convertible Notes and our other debt;

· If we default on our obligations to pay our other indebtedness, we may not be able to make payments on the Convertible Notes;

· The Convertible Notes will be unsecured and therefore will be effectively subordinated to any secured indebtedness we have currently incurred or may incur in the future;

· The Convertible Notes will be structurally subordinated to the indebtedness and other liabilities of our subsidiaries;

· The indenture governing the Convertible Notes does not contain restrictive covenants and provides only limited protection in the event of a change of control;

· The conversion rate of the Convertible Notes may not be adjusted for all dilutive events that may adversely affect the trading price of the Convertible Notes or the common stock issuable upon conversion of the Convertible Notes;

S-7

· We may be unable to repurchase the Convertible Notes following a fundamental change;

· Some significant restructuring transactions may not constitute a fundamental change, in which case we would not be obligated to offer to repurchase the Convertible Notes;

· Provisions of the Convertible Notes could discourage an acquisition of us by a third party;

· The adjustment to the conversion rate upon the occurrence of certain types of fundamental changes may not adequately compensate you for the lost option time value of your Convertible Notes as a result of such fundamental change;

· There is currently no public market for the Convertible Notes, and an active trading market may not develop for the Convertible Notes. The failure of a market to develop for the Convertible Notes could adversely affect the liquidity and value of your Convertible Notes;

· Recent regulatory actions may adversely affect the trading price and liquidity of the Convertible Notes;

· The accounting for convertible debt securities is subject to uncertainty;

· The price of our common stock and of the Convertible Notes may fluctuate significantly, and this may make it difficult for you to resell the Convertible Notes or common stock issuable upon conversion of the Convertible Notes when you want or at prices you find attractive;

· Future sales of our common stock in the public market or the issuance of securities senior to our common stock could adversely affect the trading price of our common stock and the value of the Convertible Notes and our ability to raise funds in new stock offerings;

· Holders of the Convertible Notes will not be entitled to any rights with respect to our common stock, but will be subject to all changes made with respect to our common stock;

· You may be deemed to receive a taxable distribution without the receipt of any cash or property;

· We may suffer credit losses;

· We do not expect to replicate the Predecessor Entities’ nor our historical performance or the historical performance of other entities managed or supported by New Mountain Capital;

· There is uncertainty as to the value of our portfolio investments because most of our investments are, and may continue to be in private companies and recorded at fair value;

· Our ability to achieve our investment objective depends on key investment personnel of the Investment Adviser. If the Investment Adviser were to lose any of its key investment personnel, our ability to achieve our investment objective could be significantly harmed;

· The Investment Adviser has limited experience managing a BDC or a RIC, which could adversely affect our business;

· We operate in a highly competitive market for investment opportunities and may not be able to compete effectively;

· Our investments in securities rated below investment grade are speculative in nature and are subject to additional risk factors such as increased possibility of default, illiquidity of the security, and changes in value based on changes in interest rates;

· Our business, results of operations and financial condition depends on our ability to manage future growth effectively;

· We borrow money, which could magnify the potential for gain or loss on amounts invested in us and increase the risk of investing in us;

· Changes in interest rates may affect our cost of capital and net investment income;

· Regulations governing the operations of BDCs will affect our ability to raise additional equity capital as well as our ability to issue senior securities or borrow for investment purposes, any or all of which could have a negative effect on our investment objectives and strategies;

· We may experience fluctuations in our annual and quarterly results due to the nature of our business;

· Our board of directors may change our investment objective, operating policies and strategies without prior notice or stockholder approval, the effects of which may be adverse to your interests;

· We will be subject to corporate-level U.S. federal income tax on all of our income if we are unable to maintain RIC status under Subchapter M of the Code, which would have a material adverse effect on our financial performance;

· We may not be able to pay you distributions on our common stock, our distributions to you may not grow over time and a portion of our distributions to you may be a return of capital for U.S. federal income tax purposes;

· Our investments in portfolio companies may be risky, and we could lose all or part of any of our investments;

· The lack of liquidity in our investments may adversely affect our business;

S-8

· Economic recessions, downturns or government spending cuts could impair our portfolio companies and harm our operating results;

· The market price of our common stock may fluctuate significantly; and

· Sales of substantial amounts of our common stock in the public market may have an adverse effect on the market price of our common stock.

[Insert any additional risk factors applicable to Convertible Notes.]

Company Information

Our administrative and executive offices are located at 787 Seventh Avenue, 48th Floor, New York, New York 10019, and our telephone number is (212) 720-0300. We maintain a website at www.newmountainfinance.com. Information contained on our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus, and you should not consider information contained on our website to be part of this prospectus supplement or the accompanying prospectus.

Presentation of Historical Financial Information and Market Data

Historical Financial Information

Unless otherwise indicated, historical references contained in this prospectus supplement or the accompanying prospectus for periods prior to and as of December 31, 2013 in “Selected Financial and Other Data”, “Selected Quarterly Data”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Senior Securities” and “Portfolio Companies” relate to NMF Holdings. The consolidated financial statements of New Mountain Finance Holdings, L.L.C., formerly known as New Mountain Guardian (Leveraged), L.L.C., and New Mountain Guardian Partners, L.P. are NMF Holdings’ historical consolidated financial statements.

Market Data

Statistical and market data used in this prospectus supplement and the accompanying prospectus has been obtained from governmental and independent industry sources and publications. We have not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained in this prospectus supplement and accompanying prospectus. See “Cautionary Statement Regarding Forward-Looking Statements” in this prospectus supplement and the accompanying prospectus.

S-9

SPECIFIC TERMS OF THE NOTES AND THE OFFERING

This prospectus supplement sets forth certain terms of the Convertible Notes that we are offering pursuant to this prospectus supplement and supplements the accompanying prospectus that is attached to the back of this prospectus supplement. On June [ ], 20[ ], we and the Trustee entered into the indenture relating to our issuance, offer and sale of the Convertible Notes. This section outlines the specific legal and financial terms of the Convertible Notes. You should read this section before investing in the Convertible Notes. Capitalized terms used in this prospectus supplement and not otherwise defined shall have the meanings ascribed to them in the indenture governing the Convertible Notes.

|

Issuer |

|

New Mountain Finance Corporation |

|

|

|

|

|

Title of the Securities |

|

[ ]% Convertible Notes due 20[ ] |

|

|

|

|

|

Aggregate Principal Amount Being Offered |

|

$[ ] |

|

|

|

|

|

Overallotment Option |

|

We have granted the underwriters an option to purchase up to an additional $[ ] aggregate principal amount of Convertible Notes to cover overallotments, if any, exercisable within [ ] days from the date of this prospectus supplement. |

|

|

|

|

|

Initial Public Offering Price |

|

[ ]% of the aggregate principal amount, plus accrued interest from June [ ], 20[ ] |

|

|

|

|

|

Maturity |

|

[ ], 20[ ], unless earlier converted or repurchased |

|

|

|

|

|

Principal Payable at Maturity |

|

[ ]% of the aggregate principal amount; the principal amount of each Convertible Note will be payable on its stated maturity date |

|

|

|

|

|

Interest Rate |

|

[ ]% per year |

|

|

|

|

|

Interest Payment Dates |

|

Interest will be payable in cash on [ ], and [ ] of each year, beginning [ ]. |

|

|

|

|

|

Interest Periods |

|

The initial interest period will be the period from and including [ ], 20[ ] to, but excluding, the next interest payment date, and the subsequent interest periods will be the periods from and including an interest payment date to, but excluding, the next interest payment date. |

|

|

|

|

|

Ranking |

|

The Convertible Notes will be our general, unsecured obligations and will rank: |

|

|

|

|

|

|

|

· equal in right of payment with all of our existing and future unsecured indebtedness, including $[ ] million and $[ ] million in aggregate principal amount of Convertible Notes and Unsecured Notes, respectively; |

|

|

|

|

|

|

|

· senior in right of payment to all of our future indebtedness that is expressly subordinated in right of payment to the Convertible Notes; |

|

|

|

|

|

|

|

· effectively subordinated to our existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness, including $[ ] million outstanding under the NMFC Credit Facility; and |

|

|

|

|

|

|

|

· structurally subordinated to any existing and future liabilities and other indebtedness of our subsidiaries, including $[ ] million outstanding under the Holdings Credit Facility and $[ ]million outstanding under the SBA-guaranteed debentures. |

S-10

|

|

|

As of [ ], 20[ ], we had $[ ] million of indebtedness outstanding, $[ ] million of which was secured indebtedness and $[ ] million of which was unsecured indebtedness. |

|

|

|

|

|

Denominations |

|

We will issue the Convertible Notes in book-entry form only in denominations of $1,000 principal amount and integral multiples thereof. |

|

|

|

|

|

Business Day |

|

Any day other than a Saturday, a Sunday or a day on which the Federal Reserve Bank of New York or the Trustee is authorized or required by law or executive order to close or be closed. |

|

|

|

|

|

Redemption |

|

We may not redeem the Convertible Notes prior to maturity. |

|

|

|

|

|

Sinking Fund |

|

The Convertible Notes will not be subject to any sinking fund. |

|

|

|

|

|

Defeasance |

|

The Convertible Notes are not subject to defeasance. |

|

|

|

|

|

Conversion Rights |

|

You may convert your Convertible Notes into shares of our common stock at any time on or prior to the close of business on the business day immediately preceding the maturity date. |

|

|

|

|

|

|

|

The Convertible Notes will be convertible at an initial conversion rate of [ ] shares of common stock per $1,000 principal amount of the Convertible Notes (equivalent to an initial conversion price of approximately $[ ] per share). The conversion rate, and thus the conversion price, may be adjusted under certain circumstances as described under “Description of the Notes — Conversion Rights — Conversion Rate Adjustments”. |

|

|

|

|

|

|

|

Upon any conversion, unless you convert after a record date for an interest payment but prior to the corresponding interest payment date, you will receive a cash payment representing accrued and unpaid interest to, but not including, the conversion date. See “Description of the Notes — Conversion Rights”. |

|

|

|

|

|

Limitation on Beneficial Ownership |

|

Notwithstanding the foregoing, no holder of Convertible Notes will be entitled to receive shares of our common stock upon conversion to the extent (but only to the extent) that such receipt would cause such converting holder to become, directly or indirectly, a “beneficial owner” (within the meaning of Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder) of more than [ ]% of the shares of our common stock outstanding at such time (the “Limitation”). Any purported delivery of shares of our common stock upon conversion of Convertible Notes shall be void and have no effect to the extent (but only to the extent) that such delivery would result in the converting holder becoming the beneficial owner of more than [ ]% of the shares of common stock outstanding at such time. If any delivery of shares of our common stock owed to a holder upon conversion of Convertible Notes is not made, in whole or in part, as a result of the Limitation, our obligation to make such delivery shall not be extinguished and we shall deliver such shares as promptly as practicable after any such converting holder gives notice to us that such delivery would not result in it being the beneficial owner of more than [ ]% of the shares of common stock outstanding at such time. The Limitation shall no longer apply following the effective date of any Fundamental Change, as defined in “Description of the Notes — Fundamental Change Put”. |

S-11

|

Adjustment to Conversion Rate Upon a Non-Stock Change of Control |

|

If and only to the extent holders elect to convert the Convertible Notes in connection with a transaction described under clause (1), (2) or (4) of the definition of fundamental change as described in “Description of the Notes — Fundamental Change Put” and determined after giving effect to any exceptions to or exclusions from such definition, but without regard to the provision in clause (2) of the definition thereof, pursuant to which more than 10.0% of the consideration for our common stock (other than cash payments for fractional shares and cash payments made in respect of dissenters’ appraisal rights) consists of cash or securities (or other property) that are not shares of common stock traded or scheduled to be traded immediately following such transaction on the New York Stock Exchange (the “NYSE”), the NASDAQ Global Market or the NASDAQ Global Select Market (or any of their respective successors), which we refer to as a “non-stock change of control”, we will increase the conversion rate by a number of additional shares determined by reference to the table in “Description of the Notes — Conversion Rights — Adjustment to Conversion Rate Upon a Non-Stock Change of Control”, based on the effective date and the price paid per share of our common stock in such nonstock change of control. If the price paid per share of our common stock in the fundamental change is less than $[ ] or more than $[ ] (subject to adjustment), there will be no such adjustment. If holders of our common stock receive only cash in the type of transaction described above, the price paid per share will be the cash amount paid per share. Otherwise, the stock price shall be the average of the last reported sale prices of our common stock over the five trading-day period ending on, and including, the trading day immediately preceding the effective date of the non-stock change of control. |

|

|

|

|

|

Fundamental Change Repurchase Right of Holders |

|

If we undergo a fundamental change (as defined in this prospectus supplement) prior to maturity, you will have the right, at your option, to require us to repurchase for cash some or all of your Convertible Notes at a repurchase price equal to 100.0% of the principal amount of the Convertible Notes being repurchased, plus accrued and unpaid interest to, but not including, the repurchase date. See “Description of the Notes — Fundamental Change Put”. |

|

|

|

|

|

Events of Default |

|

If an event of default on the Convertible Notes occurs, the principal amount of the Convertible Notes, plus accrued and unpaid interest (including additional interest, if any) may be declared immediately due and payable, subject to certain conditions set forth in the indenture. These amounts automatically become due and payable in the case of certain types of bankruptcy or insolvency events of default involving NMFC. |

|

|

|

|

|

No Established Trading Market |

|

We cannot assure you that any active or liquid market will develop for the Convertible Notes. See “Underwriting”. |

|

|

|

|

|

No Listing |

|

We do not intend to apply to have the Convertible Notes listed on any securities exchange or for inclusion of the Convertible Notes in an automated quotation system. Our common stock is traded on the NYSE under the symbol “NMFC”. |

|

|

|

|

|

Use of Proceeds |

|

We estimate that the net proceeds we will receive from the sale of the $[ ] million aggregate principal amount of Convertible Notes in this offering will be approximately $[ ] million (or approximately $[ ] million if the underwriters fully exercise their overallotment option), plus $[ ] of accrued interest (per $1,000 principal amount) from [ ], 20[ ], after deducting the discounts, commissions and expenses payable by us. |

S-12

|

|

|

We intend to use the net proceeds from this offering to repay outstanding indebtedness under our credit facilities. However, through re-borrowing under our credit facilities, we also intend to use the net proceeds from this offering to make new investments in accordance with our investment objective and strategies described in this prospectus supplement and the accompanying prospectus and use available capital for other general corporate purposes, including working capital requirements. We are continuously identifying, reviewing and, to the extent consistent with our investment objective, funding new investments. As a result, we typically raise capital as we deem appropriate to fund such new investments. We expect that it will take up to three months for us to substantially invest the net proceeds from this offering, depending on the availability of attractive opportunities and market conditions. However, we can offer no assurance that we will be able to achieve this goal. Proceeds not immediately used for the temporary repayment of debt under our credit facilities or for new investments will be invested primarily in cash, cash equivalents, U.S. government securities and other high-quality investments that mature in one year or less from the date of investment. These temporary investments are expected to provide a lower net return than we hope to achieve from our target investments. See “Use of Proceeds”. |

|

|

|

|

|

Certain U.S. Federal Income Tax Consequences |

|

You should consult your tax advisor with respect to the U.S. federal income tax consequences of the purchase ownership, disposition and conversion of the Convertible Notes, our qualification and taxation as a RIC for U.S. federal income tax purposes and the ownership and disposition of shares of our common stock and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. See “Additional Material Federal Income Tax Considerations” in this prospectus supplement and “Material Federal Income Tax Considerations” in the accompanying prospectus. |

|

|

|

|

|

Book-Entry Form |

|

The Convertible Notes will be issued in book-entry form and will be represented by permanent global certificates deposited with, or on behalf of, The Depository Trust Company (“DTC”) and registered in the name of a nominee of DTC. Beneficial interests in any of the Convertible Notes will be shown on, and transfers will be effected only through, records maintained by DTC or its nominee and any such interest may not be exchanged for certificated securities, except in limited circumstances. |

|

|

|

|

|

Trustee, Paying Agent and Conversion Agent |

|

[ ]. |

|

|

|

|

|

Available Information |

|

We have filed with the SEC a registration statement on Form N-2 together with all amendments and related exhibits under the Securities Act of 1933, as amended (the “Securities Act”). The registration statement contains additional information about us and the securities being offered by this prospectus supplement and the accompanying prospectus. |

|

|

|

|

|

|

|

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. This information is available at the SEC’s public reference room at 100 F Street, NE, Washington, District of Columbia 20549 and on the SEC’s website at http://www.sec.gov. The public may obtain information on the operation of the SEC’s public reference room by calling the SEC at 1-800-SEC-0330. This information is also available free of charge by contacting us at New Mountain Finance Corporation, 787 Seventh Avenue, |

S-13

|

|

|

48th Floor, New York, New York 10019, by telephone at (212) 720-0300, or on our website at www.newmountainfinance.com. Information contained on our website or on the SEC’s web site about us is not incorporated into this prospectus supplement and the accompanying prospectus and you should not consider information contained on our website or on the SEC’s website to be part of this prospectus supplement and the accompanying prospectus. |

S-14

FEES AND EXPENSES

The following table is intended to assist you in understanding the costs and expenses that you will bear directly or indirectly on an as-converted basis. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus supplement and the accompanying prospectus contains a reference to fees or expenses paid by “you”, “NMFC”, or “us” or that “we”, “NMFC”, or the “Company” will pay fees or expenses, we will pay such fees and expenses out of our net assets and, consequently, you will indirectly bear such fees or expenses as an investor in us. However, you will not be required to deliver any money or otherwise bear personal liability or responsibility for such fees or expenses.

|

Stockholder transaction expenses: |

|

|

|

|

Sales load borne by us (as a percentage of offering price) |

|

[ ] |

%(1) |

|

Offering expenses borne by us (as a percentage of offering price) |

|

[ ] |

%(2) |

|

Dividend reinvestment plan fees |

|

N/A |

(3) |

|

Total stockholder transaction expenses (as a percentage of offering price) |

|

[ ] |

% |

|

Annual expenses (as a percentage of net assets attributable to common stock): |

|

|

|

|

Base management fees |

|

[ ] |

%(4) |

|

Incentive fees payable under the Investment Management Agreement |

|

[ ] |

%(5) |

|

Interest payments on borrowed funds (other than the Convertible Notes offered hereby) |

|

[ ] |

%(6) |

|

Interest payments on the Convertible Notes offered hereby |

|

[ ] |

% |

|

Other expenses |

|

[ ] |

%(7) |

|

Acquired fund fees and expenses |

|

[ ] |

%(8) |

|

Total annual expenses |

|

[ ] |

%(9) |

Example

The following example, required by the SEC, demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our common stock. In calculating the following expense amounts, we have assumed that our borrowings and annual operating expenses would remain at the levels set forth in the table above. See Note 6 below for additional information regarding certain assumptions regarding our level of leverage.

|

|

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

|

You would pay the following expenses on a $1,000 investment, assuming a 5.0% annual return |

|

$ |

[ ] |

|

$ |

[ ] |

|

$ |

[ ] |

|

$ |

[ ] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The example should not be considered a representation of future expenses, and actual expenses may be greater or less than those shown.

While the example assumes, as required by the applicable rules of the SEC, a 5.0% annual return, our performance will vary and may result in a return greater or less than 5.0%. The incentive fee under the Investment Management Agreement, which, assuming a 5.0% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is not included in the above example. The above illustration assumes that we will not realize any capital gains (computed net of all realized capital losses and unrealized capital depreciation) in any of the indicated time periods. If we achieve sufficient returns on our investments, including through the realization of capital gains, to trigger an incentive fee of a material amount, our expenses and returns to our investors would be higher. For example, if we assumed that we received our 5.0% annual return completely in the form of net realized capital gains on our investments, computed net of all cumulative

S-15

unrealized depreciation on our investments, the projected dollar amount of total cumulative expenses set forth in the above illustration would be as follows:

|

|

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

|

You would pay the following expenses on a $1,000 investment, assuming a 5.0% annual return |

|

$ |

[ ] |

|

$ |

[ ] |

|

$ |

[ ] |

|

$ |

[ ] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The example assumes a sales load borne by us of [ ]%. In addition, while the examples assume reinvestment of all distributions at net asset value, participants in our dividend reinvestment plan will receive a number of shares of our common stock determined by dividing the total dollar amount of the distribution payable to a participant by the market price per share of our common stock at the close of trading on the dividend payment date. The market price per share of our common stock may be at, above or below net asset value. See “Dividend Reinvestment Plan” in the accompanying prospectus for additional information regarding the dividend reinvestment plan.

(1) Represents the commission with respect to the Convertible Notes being sold in this offering, which we will pay to the underwriters in connection with sales of Convertible Notes effected by the underwriters in this offering.

(2) The offering expenses of this offering are estimated to be approximately $[ ] million.

(3) The de minimis expenses of the dividend reinvestment plan are included in “other expenses”.

(4) The base management fee under the Investment Management Agreement is based on an annual rate of 1.75% of our average gross assets for the two most recent quarters, which equals our total assets on the Consolidated Statements of Assets and Liabilities, less (i) the borrowings under the SLF Credit Facility and (ii) cash and cash equivalents. We have not invested, and currently do not invest, in derivatives. To the extent we invest in derivatives in the future, we will use the actual value of the derivatives, as reported on our Consolidated Statements of Assets and Liabilities, for purposes of calculating our base management fee. Since our IPO, the base management fee calculation has deducted the borrowings under the SLF Credit Facility. The SLF Credit Facility had historically consisted of primarily lower yielding assets at higher advance rates. As part of an amendment to our existing credit facilities with Wells Fargo Bank, National Association, the SLF Credit Facility merged with the Predecessor Holdings Credit Facility and into the Holdings Credit Facility on December 18, 2014. Post credit facility merger and to be consistent with the methodology since our IPO, the Investment Adviser will continue to waive management fees on the leverage associated with those assets that share the same underlying yield characteristics with investments leveraged under the legacy SLF Credit Facility. The Investment Adviser cannot recoup management fees that the Investment Adviser has previously waived. The base management fee reflected in the table above is based on the six months ended [ ], 20[ ] and is calculated without deducting any management fees waived. The annual base management fee after deducting the management fee waiver as a percentage of net assets would be [ ]% based on the six months ended [ ], 20[ ]. See “Investment Management Agreement” in the accompanying prospectus.

(5) Assumes that annual incentive fees earned by the Investment Adviser remain consistent with the incentive fees earned by the Investment Adviser during the six months ended [ ], 20[ ] and includes accrued capital gains incentive fee. These accrued capital gains incentive fees would be paid by us if we ceased operations on [ ], 20[ ] and liquidated our investments at the [ ], 20[ ] valuation. As we cannot predict whether we will meet the thresholds for incentive fees under the Investment Management Agreement, the incentive fees paid in subsequent periods, if any, may be substantially different than the fees incurred during the six months ended [ ], 20[ ]. For more detailed information about the incentive fee calculations, see the “Investment Management Agreement” section of the accompanying prospectus.

(6) We may borrow funds from time to time to make investments to the extent we determine that additional capital would allow us to take advantage of additional investment opportunities or if the economic situation is otherwise conducive to doing so. The costs associated with these borrowings are indirectly borne by our stockholders. As of [ ], 20[ ], we had $[ ] million, $[ ] million, $[ ] million, $[ ] million and $[ ] million of indebtedness outstanding under the Holdings Credit Facility, the NMFC Credit Facility, the Convertible Notes, the Unsecured Notes and the SBA-guaranteed debentures, respectively. For purposes of this calculation, we have assumed the [ ], 20[ ] amounts outstanding under the credit facilities, Convertible Notes, Unsecured Notes and SBA-guaranteed debentures, and have computed interest expense using an assumed interest rate of [ ]% for the Holdings Credit Facility, [ ]% for the NMFC Credit Facility, [ ]% for the Convertible Notes, [ ]% for the Unsecured Notes and [ ]% for the SBA-guaranteed debentures, which were the rates payable as of [ ], 20[ ]. See “Senior Securities” in this prospectus supplement. Furthermore, we may issue additional Unsecured Notes before the end of the current fiscal year. For purposes of this calculation, we have assumed an additional $[ ] million of Unsecured Notes to be outstanding and have computed interest expense using an assumed interest rate of [ ]%.

(7) “Other expenses” include our overhead expenses, including payments by us under the Administration Agreement based on the allocable portion of overhead and other expenses incurred by the Administrator in performing its obligations to us under the Administration Agreement. Pursuant to the Administration Agreement, the Administrator may, in its own discretion, submit to us for reimbursement some or all of the expenses that the Administrator has incurred on our behalf during any quarterly period. As a result, the amount of expenses for which we will have to reimburse the Administrator may fluctuate in future quarterly periods and there can be no assurance given as to when, or if, the Administrator may determine to limit the expenses that the Administrator submits to us for reimbursement in the future. However, it is expected that the Administrator will continue to support part of our expense burden in the near future and may decide to not calculate and charge through certain overhead related amounts as well as continue to cover some of the indirect costs. The Administrator cannot recoup any expenses that the Administrator has previously waived. This expense ratio is calculated without deducting any expenses waived or reimbursed by the Administrator. Assuming the expenses waived or reimbursed by the Administrator at [ ], 20[ ], the annual expense ratio after deducting the expenses waived or reimbursed by the Administrator as a percentage of net assets would be [ ]%. For the six months ended [ ], 20[ ], we reimbursed our Administrator approximately $[ ]

S-16

million, which represents approximately [ ]% of our net assets on an annualized basis. See “Administration Agreement” in the accompanying prospectus.

(8) The holders of shares of our common stock indirectly bear the expenses of our investment in NMFC Senior Loan Program I, LLC (“SLP I”) and NMFC Senior Loan Program II, LLC (“SLP II”). No management fee is charged on our investment in SLP I in connection with the administrative services provided to SLP I. As SLP II is structured as a private joint venture, no management fees are paid by SLP II. Future expenses for SLP I and SLP II may be substantially higher or lower because certain expenses may fluctuate over time.

(9) The holders of shares of our common stock indirectly bear the cost associated with our annual expenses.

SELECTED FINANCIAL AND OTHER DATA

The selected financial data should be read in conjunction with the respective consolidated financial statements and related consolidated notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus supplement and the accompanying prospectus. Financial information for the years ended December 31, 20[ ], December 31, 20[ ], December 31, 20[ ], December 31, 20[ ] and December 31, 20[ ] has been derived from the Predecessor Operating Company and our financial statements and the related notes thereto that were audited by Deloitte & Touche LLP, an independent registered public accounting firm. The financial information at and for the six months ended [ ], 20[ ] was derived from our unaudited consolidated financial statements and related consolidated notes. In the opinion of management, all adjustments, consisting solely of normal recurring accruals, considered necessary for the fair presentation of financial statements for the interim periods, have been included. Our results for the interim periods may not be indicative of our results for any future interim period or the full year. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Senior Securities” in this prospectus supplement and the accompanying prospectus for more information.

The below selected financial and other data is for NMFC.

[Insert Selected Financial and Other Data of New Mountain Finance Corporation reflecting most recently filed financials prior to the offering.]

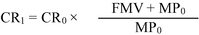

SUPPLEMENTARY RISK FACTORS