Exhibit 99.4

This preliminary prospectus supplement relates to an effective registration statement under the Securities Act of 1933, as amended, but the information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell and are not soliciting an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

[FORM OF PRELIMINARY PROSPECTUS SUPPLEMENT TO BE USED IN

CONJUNCTION WITH FUTURE WARRANT OFFERINGS](1)

PRELIMINARY PROSPECTUS SUPPLEMENT

(to Prospectus dated , 20 )

[ ] Shares

New Mountain Finance Corporation

Warrants to Purchase Up to [Type of Security]

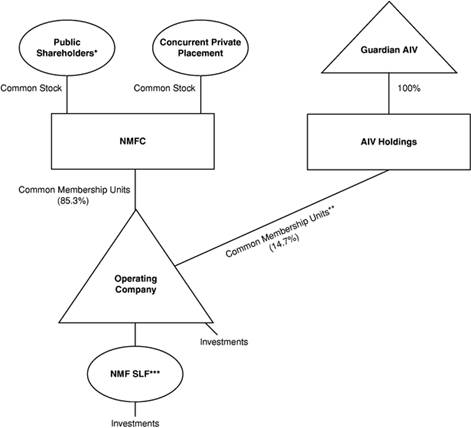

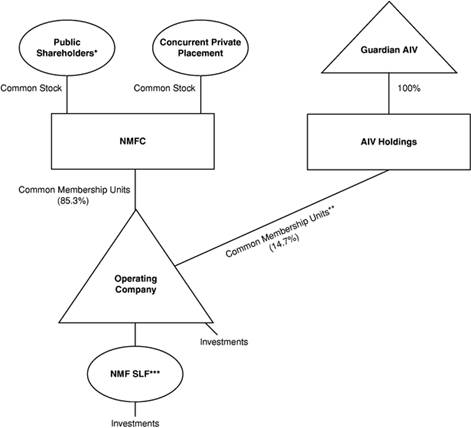

New Mountain Finance Corporation (“NMFC”) is a holding company with no direct operations of its own, and its only business and sole asset is its ownership of common membership units of New Mountain Finance Holdings, L.L.C. (the “Operating Company”). The Operating Company is an externally managed business development company managed by New Mountain Finance Advisers BDC, L.L.C. and is the operating company for NMFC’s business. NMFC and the Operating Company each have elected to be treated as a business development company under the Investment Company Act of 1940. The Operating Company’s investment objective is to generate current income and capital appreciation through the sourcing and origination of debt securities at all levels of the capital structure, including first and second lien debt, notes, bonds and mezzanine securities. As of September 30, 2013, NMFC owned approximately 85.3% of the common membership units of the Operating Company and New Mountain Finance AIV Holdings Corporation owned approximately 14.7% of the common membership units of the Operating Company.

We are offering for sale warrants to purchase up to [type of security]. Each warrant entitles the holder to purchase [type of security].

(1) In addition to the sections outlined in this form of prospectus supplement, each prospectus supplement actually used in connection with an offering conducted pursuant to the registration statement to which this form of prospectus supplement is attached will be updated to include such other information as may then be required to be disclosed therein pursuant to applicable law or regulation as in effect as of the date of each such prospectus supplement, including, without limitation, information particular to the terms of each security offered thereby and any related risk factors or tax considerations pertaining thereto. This form of prospectus supplement is intended only to provide a rough approximation of the nature and type of disclosure that may appear in any actual prospectus supplement used for the purposes of offering securities pursuant to the registration statement to which this form of prospectus supplement is attached, and is not intended to and does not contain all of the information that would appear is any such actual prospectus supplement, and should not be used or relied upon in connection with any offer or sale of securities.

The exercise price will be $ per warrant. The warrants will be exercisable beginning on , 20 , and will expire on , 20 , or earlier upon redemption.

NMFC’s common stock is listed on the New York Stock Exchange under the symbol “NMFC”. On , 20 , the last reported sales price on the New York Stock Exchange for NMFC’s common stock was $ per share.

An investment in NMFC’s warrants is very risky and highly speculative. Shares of closed-end investment companies, including business development companies, frequently trade at a discount to their net asset value. In addition, the companies in which NMFC invests, through the Operating Company, are subject to special risks. See “Risk Factors” beginning on page [ ] of the accompanying prospectus to read about factors you should consider, including the risk of leverage, before investing in NMFC’s warrants.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus supplement and the accompanying prospectus contain important information about NMFC and the Operating Company that a prospective investor should know before investing in NMFC’s warrants. Please read this prospectus supplement and the accompanying prospectus before investing and keep it for future reference. NMFC and the Operating Company file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (http://www.sec.gov), which is available free of charge by contacting NMFC by mail at 787 Seventh Avenue, 48th Floor, New York, New York 10019 or on our website at http://www.newmountainfinance.com. Information contained on our website is not incorporated by reference into this prospectus supplement and the accompanying prospectus, and you should not consider that information to be part of this prospectus supplement and the accompanying prospectus.

|

|

|

Per Share |

|

Total |

|

|

Public Offering Price |

|

$ |

|

|

$ |

|

|

|

Sales Load (Underwriting Discounts and Commissions) |

|

$ |

|

|

$ |

|

|

|

Proceeds to us (before expenses) |

|

$ |

|

|

$ |

|

|

(1) All expenses of the offering, including the sales load, will be borne by the Operating Company. The Operating Company will incur approximately $[ ] of estimated expenses, excluding the sales load, in connection with this offering. Stockholders will indirectly bear such expenses, including the sales load, through NMFC’s ownership of common membership units of the Operating Company.

(2) To the extent that the underwriters sell more than [ ] NMFC warrants, the underwriters have the option to purchase up to an additional [ ] NMFC warrants at the public offering price, less the sales load, within [ ] days of the date of this prospectus. If the underwriters exercise this option in full, the total public offering price, sales load and proceeds to us will be $ , $ and $ , respectively. If the underwriters exercise their option to purchase additional NMFC warrants, NMFC will use the proceeds from the exercise of this option to purchase additional common membership units of the Operating Company.

The underwriters expect to deliver the warrants against payment in New York, New York on or about , 20 .

, 20

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

|

Page |

|

ABOUT THIS PROSPECTUS SUPPLEMENT |

S-1 |

|

PROSPECTUS SUPPLEMENT SUMMARY |

S-2 |

|

SPECIFIC TERMS OF OUR WARRANTS AND THE OFFERING |

S-11 |

|

FEES AND EXPENSES |

S-12 |

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

S-14 |

|

RISK FACTORS |

S-15 |

|

CAPITALIZATION |

S-16 |

|

USE OF PROCEEDS |

S-17 |

|

DESCRIPTION OF OUR WARRANTS |

S-18 |

|

UNDERWRITING |

S-19 |

|

LEGAL MATTERS |

S-22 |

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

S-22 |

|

AVAILABLE INFORMATION |

S-22 |

PROSPECTUS

|

ABOUT THIS PROSPECTUS |

iii |

|

PROSPECTUS SUMMARY |

1 |

|

THE OFFERING |

12 |

|

FEES AND EXPENSES |

17 |

|

SELECTED FINANCIAL AND OTHER DATA |

20 |

|

SELECTED QUARTERLY FINANCIAL DATA |

23 |

|

RISK FACTORS |

25 |

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

62 |

|

USE OF PROCEEDS |

64 |

|

PRICE RANGE OF COMMON STOCK AND DISTRIBUTIONS |

65 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

68 |

|

SENIOR SECURITIES |

99 |

|

BUSINESS |

100 |

|

PORTFOLIO COMPANIES |

116 |

|

MANAGEMENT |

123 |

|

PORTFOLIO MANAGEMENT |

135 |

|

INVESTMENT MANAGEMENT AGREEMENT |

137 |

|

ADMINISTRATION AGREEMENT |

145 |

|

LICENSE AGREEMENT |

146 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

147 |

|

CONTROL PERSONS AND PRINCIPAL STOCKHOLDERS |

150 |

|

SELLING STOCKHOLDERS |

153 |

|

DETERMINATION OF NET ASSET VALUE |

155 |

|

DIVIDEND REINVESTMENT PLAN |

158 |

|

DESCRIPTION OF NMFC’S SECURITIES |

160 |

|

DESCRIPTION OF NMFC’S CAPITAL STOCK |

160 |

|

DESCRIPTION OF NMFC’S PREFERRED STOCK |

165 |

S-i

|

DESCRIPTION OF NMFC’S SUBSCRIPTION RIGHTS |

166 |

|

DESCRIPTION OF NMFC’S WARRANT’S |

168 |

|

DESCRIPTION OF THE OPERATING COMPANY’S DEBT SECURITIES |

170 |

|

DESCRIPTION OF STRUCTURE-RELATED AGREEMENTS |

186 |

|

SHARES ELIGIBLE FOR FUTURE SALE |

193 |

|

MATERIAL FEDERAL INCOME TAX CONSIDERATIONS |

194 |

|

REGULATION |

211 |

|

PLAN OF DISTRIBUTION |

217 |

|

SAFEKEEPING AGENT, TRANSFER AND DISTRIBUTION PAYING AGENT AND REGISTRAR |

220 |

|

BROKERAGE ALLOCATION AND OTHER PRACTICES |

220 |

|

LEGAL MATTERS |

220 |

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

220 |

|

AVAILABLE INFORMATION |

221 |

|

PRIVACY NOTICE |

221 |

|

INDEX TO FINANCIAL STATEMENTS |

F-1 |

S-ii

ABOUT THIS PROSPECTUS SUPPLEMENT

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. Neither we nor the underwriters have authorized any other person to provide you with different information from that contained in this prospectus supplement or the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to buy, any of our warrants by any person in any jurisdiction where it is unlawful for that person to make such an offer or solicitation or to any person in any jurisdiction to whom it is unlawful to make such an offer or solicitation. The information contained in this prospectus supplement and the accompanying prospectus is complete and accurate only as of their respective dates, regardless of the time of their delivery or sale of our warrants. This prospectus supplement supersedes the accompanying prospectus to the extent it contains information different from or additional to the information in that prospectus.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of the warrants and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from the information contained in the accompanying prospectus, the information in this prospectus supplement shall control. Please carefully read this prospectus supplement and the accompanying prospectus together with any exhibits and the additional information described under “Available Information” and in the “Summary” and “Risk Factors” sections before you make an investment decision.

S-1

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights some of the information in this prospectus supplement and the accompanying prospectus. It is not complete and may not contain all of the information that you may want to consider. You should read carefully the more detailed information set forth under “Risk Factors” and the other information included in this prospectus supplement and the accompanying prospectus and the documents to which we have referred.

In this prospectus supplement, unless the context otherwise requires, references to:

· “NMFC” refers to New Mountain Finance Corporation, a Delaware corporation, which was incorporated on June 29, 2010 in preparation for the initial public offering;

· “NMF SLF” refers to New Mountain Finance SPV Funding, L.L.C.;

· “Operating Company” refers to New Mountain Finance Holdings, L.L.C., a Delaware limited liability company, which is the operating company for our business. References to the Operating Company include New Mountain Finance Holdings, L.L.C.’s wholly-owned subsidiary, NMF SLF, unless the context otherwise requires. References to the Operating Company exclude NMF SLF when referencing the Operating Company’s common membership units, board of directors, and credit facility or leverage;

· “Guardian AIV” refers to New Mountain Guardian AIV, L.P.;

· “AIV Holdings” refers to New Mountain Finance AIV Holdings Corporation, a Delaware corporation which was incorporated on March 11, 2011, of which Guardian AIV is the sole stockholder;

· “New Mountain Finance Entities”, “we”, “us” and “our” refer to NMFC, the Operating Company and AIV Holdings, collectively; except for references to the registration statement of which this prospectus supplement forms a part and the offering of securities thereunder, in which case references to “we”, “us” and “our” refer to NMFC and the Operating Company only.

· “Investment Adviser” refers to New Mountain Finance Advisers BDC, L.L.C., the Operating Company’s investment adviser;

· “Administrator” refers to the New Mountain Finance Entities’ administrator, New Mountain Finance Administration, L.L.C.;

· “New Mountain Capital” refers to New Mountain Capital Group, L.L.C. and its affiliates;

· “Predecessor Entities” refers to New Mountain Guardian (Leveraged), L.L.C. and New Mountain Guardian Partners, L.P., together with their respective direct and indirect wholly-owned subsidiaries prior to the initial public offering;

· “Holdings Credit Facility” refers to the Operating Company’s Amended and Restated Loan and Security Agreement with Wells Fargo Bank, National Association, dated May 19, 2011, as amended;

· “SLF Credit Facility” refers to NMF SLF’s Loan and Security Agreement with Wells Fargo Bank, National Association, dated October 27, 2010, as amended; and

· “Credit Facilities” refers to the Holding Credit Facility and the SLF Credit Facility, collectively.

S-2

Overview

The Operating Company is a Delaware limited liability company. The Operating Company is externally managed and has elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). As such, the Operating Company is obligated to comply with certain regulatory requirements. The Operating Company intends to be treated as a partnership for federal income tax purposes for so long as it has at least two members.

The Operating Company is externally managed by the Investment Adviser. The Administrator provides the administrative services necessary for operations. The Investment Adviser and Administrator are wholly-owned subsidiaries of New Mountain Capital. New Mountain Capital is a firm with a track record of investing in the middle market and with assets under management (which includes amounts committed, not all of which have been drawn down and invested to date) totaling more than $9.0 billion as of September 30, 2013. New Mountain Capital focuses on investing in defensive growth companies across its private equity, public equity, and credit investment vehicles. The Operating Company, formerly known as New Mountain Guardian (Leveraged), L.L.C., was originally formed as a subsidiary of Guardian AIV by New Mountain Capital in October 2008. Guardian AIV was formed through an allocation of approximately $300.0 million of the $5.1 billion of commitments supporting New Mountain Partners III, L.P., a private equity fund managed by New Mountain Capital. In February 2009, New Mountain Capital formed a co-investment vehicle, New Mountain Guardian Partners, L.P., comprising $20.4 million of commitments.

NMFC is a Delaware corporation that was originally incorporated on June 29, 2010. NMFC is a closed-end, non-diversified management investment company that has elected to be treated as a BDC under the 1940 Act. As such, NMFC is obligated to comply with certain regulatory requirements. NMFC has elected to be treated, and intends to comply with the requirements to continue to qualify annually, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended, (the “Code”).

AIV Holdings is a Delaware corporation that was originally incorporated on March 11, 2011. Guardian AIV, a Delaware limited partnership, is AIV Holdings’ sole stockholder. AIV Holdings is a closed-end, non-diversified management investment company that has elected to be treated as a BDC under the 1940 Act. As such, AIV Holdings is obligated to comply with certain regulatory requirements. AIV Holdings has elected to be treated, and intends to comply with the requirements to continue to qualify annually, as a RIC under the Code.

On May 19, 2011, NMFC priced its initial public offering (the “IPO”) of 7,272,727 shares of common stock at a public offering price of $13.75 per share. Concurrently with the closing of the IPO and at the public offering price of $13.75 per share, NMFC sold an additional 2,172,000 shares of its common stock to certain executives and employees of, and other individuals affiliated with, New Mountain Capital in a concurrent private placement (the “Concurrent Private Placement”). Additionally, 1,252,964 shares were issued to the partners of New Mountain Guardian Partners, L.P. at that time for their ownership interest in the Predecessor Entities. In connection with NMFC’s IPO and through a series of transactions, the Operating Company owns all of the operations of the Predecessor Entities, including all of the assets and liabilities related to such operations.

NMFC and AIV Holdings are holding companies with no direct operations of their own, and their sole asset is their ownership in the Operating Company. NMFC and AIV Holdings each entered into a joinder agreement with respect to the Limited Liability Company Agreement, as amended and restated, of the Operating Company, pursuant to which NMFC and AIV Holdings were admitted as members of the Operating Company. NMFC acquired from the Operating Company, with the gross proceeds of the IPO and the Concurrent Private Placement, common membership units (“units”) of the Operating Company (the number of units are equal to the number of shares of NMFC’s common stock sold in the IPO and the Concurrent Private Placement). Additionally, NMFC received units of the Operating Company equal to the number of shares of common stock of NMFC issued to the partners of New Mountain Guardian Partners, L.P. Guardian AIV was the parent of the Operating Company prior to the IPO and, as a result of the transactions completed in connection with the IPO, obtained units in the Operating Company. Guardian AIV contributed its units in the Operating Company to its newly formed subsidiary, AIV Holdings, in exchange for common stock of AIV Holdings. AIV Holdings has the right to exchange all or any portion of its units in the Operating Company for shares of NMFC’s common stock on a one-for-one basis at any time.

Since NMFC’s IPO, and through September 30, 2013, NMFC raised approximately $190.4 million in net proceeds from additional offerings of common stock and issued shares valued at approximately $193.7 million to

S-3

AIV Holdings for exchanged units. NMFC acquired from the Operating Company units of the Operating Company equal to the number of shares of NMFC’s common stock sold in additional offerings. As of September 30, 2013, NMFC and AIV Holdings owned approximately 85.3% and 14.7%, respectively, of the units of the Operating Company.

The current structure was designed to generally prevent NMFC and its stockholders from being allocated taxable income with respect to unrecognized gains that existed at the time of the IPO in the Predecessor Entities’ assets, and rather such amounts would be allocated generally to AIV Holdings and its stockholders. The result is that any distributions made to NMFC’s stockholders that are attributable to such gains generally will not be treated as taxable dividends but rather as return of capital. See “Material Federal Income Tax Considerations”.

The diagram below depicts the New Mountain Finance Entities’ organizational structure as of September 30, 2013.

* Includes partners of New Mountain Guardian Partners, L.P.

** These common membership units are exchangeable into shares of NMFC common stock on a one-for-one basis.

*** New Mountain Finance SPV Funding, L.L.C. (“NMF SLF”).

The Operating Company’s investment objective is to generate current income and capital appreciation through the sourcing and origination of debt securities at all levels of the capital structure, including first and second lien

S-4

debt, notes, bonds and mezzanine securities. In some cases, the Operating Company’s investments may also include equity interests. The primary focus is in the debt of defensive growth companies, which are defined as generally exhibiting the following characteristics: (i) sustainable secular growth drivers, (ii) high barriers to competitive entry, (iii) high free cash flow after capital expenditure and working capital needs, (iv) high returns on assets and (v) niche market dominance.

As of September 30, 2013, the Operating Company’s net asset value was $641.8 million and its portfolio had a fair value of approximately $1,041.4 million in 57 portfolio companies, with a weighted average yield to maturity of approximately 10.4%. This yield to maturity calculation assumes that all investments not on non-accrual are purchased at fair value on September 30, 2013 and held until their respective maturities with no prepayments or losses and exited at par at maturity. The actual yield to maturity may be higher or lower due to the future selection of the London Interbank Offered Rate (“LIBOR”) contracts by the individual companies in the Operating Company’s portfolio or other factors.

The Investment Adviser

The Investment Adviser, a wholly-owned subsidiary of New Mountain Capital, manages the Operating Company’s day-to-day operations and provides it with investment advisory and management services. In particular, the Investment Adviser is responsible for identifying attractive investment opportunities, conducting research and due diligence on prospective investments, structuring the Operating Company’s investments and monitoring and servicing the Operating Company’s investments. We currently do not have, and do not intend to have, any employees. As of September 30, 2013, the Investment Adviser was supported by approximately 100 staff members of New Mountain Capital, including 62 investment professionals.

The Investment Adviser is managed by a five member investment committee (the “Investment Committee”), which is responsible for approving purchases and sales of the Operating Company’s investments above $5.0 million in aggregate by issuer. The Investment Committee currently consists of Steven B. Klinsky, Robert A. Hamwee, Adam Collins, Douglas Londal and John Kline. The Investment Committee is responsible for approving all of the Operating Company’s investment purchases above $5.0 million. The Investment Committee also monitors investments in the Operating Company’s portfolio and approves all asset dispositions above $5.0 million. Purchases and dispositions below $5.0 million may be approved by the Operating Company’s Chief Executive Officer. These approval thresholds are subject to change over time. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on the Investment Committee, which includes expertise in private equity, primary and secondary leveraged credit, private mezzanine finance and distressed debt.

Competitive Advantages

We believe that we have the following competitive advantages over other capital providers to middle market companies:

Proven and Differentiated Investment Style With Areas of Deep Industry Knowledge

In making its investment decisions, the Investment Adviser applies New Mountain Capital’s long-standing, consistent investment approach that has been in place since its founding more than 10 years ago. We focus on companies in less well followed defensive growth niches of the middle market space where we believe few debt funds have built equivalent research and operational size and scale.

We benefit directly from New Mountain Capital’s private equity investment strategy that seeks to identify attractive investment sectors from the top down and then works to become a well-positioned investor in these sectors. New Mountain Capital focuses on companies and industries with sustainable strengths in all economic cycles, particularly ones that are defensive in nature, that are non-cyclical and can maintain pricing power in the midst of a recessionary and/or inflationary environment. New Mountain Capital focuses on companies within sectors in which it has significant expertise (examples include federal services, software, education, niche healthcare, business services, energy and distributions and logistics) while typically avoiding investments in companies with products or services that serve markets that are highly cyclical, have the potential for long-term decline, are overly-dependent on consumer demand or are commodity-like in nature.

S-5

In making its investment decisions, the Investment Adviser has adopted the approach of New Mountain Capital, which is based on three primary investment principles:

1. A generalist approach, combined with proactive pursuit of the highest quality opportunities within carefully selected industries, identified via an intensive and structured ongoing research process;

2. Emphasis on strong downside protection and strict risk controls; and

3. Continued search for superior risk adjusted returns, combined with timely, intelligent exits and outstanding return performance.

Experienced Management Team and Established Platform

The Investment Adviser’s team members have extensive experience in the leveraged lending space. Steven B. Klinsky, New Mountain Capital’s Founder, Chief Executive Officer and Managing Director and Chairman of the board of directors of the New Mountain Finance Entities, was a general partner of Forstmann Little & Co., a manager of debt and equity funds totaling multiple billions of dollars in the 1980s and 1990s. He was also a co-founder of Goldman, Sachs & Co.’s Leverage Buyout Group in the period from 1981 to 1984. Robert A. Hamwee, Chief Executive Officer and President of the New Mountain Finance Entities and Managing Director of New Mountain Capital, was formerly President of GSC Group, Inc. (“GSC”), where he was the portfolio manager of GSC’s distressed debt funds and led the development of GSC’s CLOs. Douglas Londal, Managing Director of New Mountain Capital, was previously co-head of Goldman, Sachs & Co.’s United States (“U.S.”) mezzanine debt team. John Kline, Chief Operating Officer and Executive Vice President of the New Mountain Finance Entities and Managing Director of New Mountain Capital, worked at GSC Group as an investment analyst and trader for GSC Group’s control distressed and corporate credit funds and at Goldman, Sachs & Co. in the Credit Risk Management and Advisory Group.

Many of the debt investments that the Operating Company has made to date have been in the same companies with which New Mountain Capital has already conducted months of intensive acquisition due diligence related to potential private equity investments. We believe that private equity underwriting due diligence is usually more robust than typical due diligence for loan underwriting. In its underwriting of debt investments, the Investment Adviser is able to utilize the research and hands-on operating experience that New Mountain Capital’s private equity underwriting teams possess regarding the individual companies and industries. Business and industry due diligence is led by a team of investment professionals of the Investment Adviser that generally consists of three to seven individuals, typically based on their relevant company and/or industry specific knowledge. Additionally, the Investment Adviser is also able to utilize its relationships with operating management teams and other private equity sponsors. We believe this differentiates us from many of our competitors.

Significant Sourcing Capabilities and Relationships

We believe the Investment Adviser’s ability to source attractive investment opportunities is greatly aided by both New Mountain Capital’s historical and current reviews of private equity opportunities in the business segments we target. To date, a significant majority of the investments that the Operating Company has made are in the debt of companies and industry sectors that were first identified and reviewed in connection with New Mountain Capital’s private equity efforts, and the majority of our current pipeline reflects this as well. Furthermore, the Investment Adviser’s investment professionals have deep and longstanding relationships in both the private equity sponsor community and the lending/agency community which they have and will continue to utilize to generate investment opportunities.

Risk Management through Various Cycles

New Mountain Capital has emphasized tight control of risk since its inception and long before the recent global financial distress began. To date, New Mountain Capital has never experienced a bankruptcy of any of its portfolio companies in its private equity efforts or with respect to the Predecessor Entities’ business. The Investment

S-6

Adviser seeks to emphasize tight control of risk with our investments in several important ways, consistent with New Mountain Capital’s historical approach. In particular, the Investment Adviser:

· Emphasizes the origination or purchase of debt in what the Investment Adviser believes are defensive growth companies, which are less likely to be dependent on macro-economic cycles;

· Targets investments in companies that are preeminent market leaders in their own industries, and when possible, investments in companies that have strong management teams whose skills are difficult for competitors to acquire or reproduce; and

· Emphasizes capital structure seniority in the Investment Adviser’s underwriting process.

Access to Non Mark to Market, Seasoned Leverage Facilities

The amounts available under the Credit Facilities are generally not subject to reduction as a result of mark to market fluctuations in the Operating Company’s portfolio investments. For a detailed discussion of the Credit Facilities, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations — Liquidity and Capital Resources”.

Market Opportunity

We believe that the size of the market for investments that we target, coupled with the demands of middle market companies for flexible sources of capital at competitive terms and rates, create an attractive investment environment for us.

· The leverage finance market has a high level of financing needs over the next several years due to significant bank debt maturities. We believe that the large dollar volume of loans that need to be refinanced will present attractive opportunities to invest capital in a manner consistent with our stated objectives.

· Middle market companies continue to face difficulties in accessing the capital markets. We believe opportunities to serve the middle market will continue to exist. While many middle market companies were formerly able to raise funds by issuing high-yield bonds, we believe this approach to financing has become more difficult in recent years as institutional investors have sought to invest in larger, more liquid offerings. In addition, many private finance companies and hedge funds have reduced their middle market lending activities due to decreased availability of their own financing.

· Consolidation among commercial banks has reduced the focus on middle market lending. We believe that many traditional bank lenders to middle market businesses have either exited or de-emphasized their service and product offerings in the middle market. These traditional lenders have instead focused on lending and providing other services to large corporate clients. We believe this has resulted in fewer key players and the reduced availability of debt capital to the companies we target.

· Attractive pricing. Reduced access to, and availability of, debt capital typically increases the interest rates, or pricing, of loans for middle market lenders. Recent primary debt transactions in this market often include upfront fees, prepayment protections and, in some cases, warrants to purchase preferred stock, all of which should enhance the profitability of new loans to lenders.

· Conservative deal structures. As a result of the credit crisis, many lenders are requiring larger equity contributions from financial sponsors. Larger equity contributions create an enhanced margin of safety for lenders because leverage is a lower percentage of the implied enterprise value of the company.

· Large pool of uninvested private equity capital available for new buyouts. We expect that private equity firms will continue to pursue acquisitions and will seek to leverage their equity investments with mezzanine loans and/or senior loans (including traditional first and second lien, as well as unitranche loans) provided by companies such as ours.

S-7

Operating and Regulatory Structure

NMFC and the Operating Company are closed-end, non-diversified management investment companies that have elected to be treated as BDCs under the 1940 Act and are required to maintain an asset coverage ratio, as defined in the 1940 Act, of at least 200.0%. NMFC has no material long-term liabilities itself and its only business and sole asset is its ownership of units of the Operating Company. As a result, NMFC looks to the Operating Company’s assets for purposes of satisfying the requirements under the 1940 Act otherwise applicable to NMFC. See “Regulation”. The Operating Company and NMF SLF have long term liabilities related to the Credit Facilities.

NMFC has elected to be treated, and intends to comply with the requirements to continue to qualify annually, as a RIC under Subchapter M of the Code. See “Material Federal Income Tax Considerations”. As a RIC, NMFC generally will not have to pay corporate-level federal income taxes on any net ordinary income or capital gains that it timely distributes to its stockholders as dividends if it meets certain source-of-income, distribution and asset diversification requirements. The Operating Company intends to make distributions to its unit holders that will be sufficient to enable NMFC to pay quarterly distributions to its stockholders and to maintain its status as a RIC. NMFC intends to distribute to its stockholders substantially all of its annual taxable income, except that it may retain certain net capital gains for reinvestment in units of the Operating Company.

Risks

An investment in NMFC’s warrants involves risk, including the risk of leverage and the risk that our operating policies and strategies may change without prior notice to NMFC stockholders or prior stockholder approval. See “Risk Factors” and the other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in NMFC’s warrants. The value of the Operating Company’s assets, as well as the market price of NMFC’s warrants, will fluctuate. Our investments may be risky, and you may lose all or part of your investment in NMFC. Investing in NMFC involves other risks, including the following:

· We have a limited operating history;

· The Operating Company may suffer credit losses;

· The Operating Company does not expect to replicate the Predecessor Entities’ historical performance or the historical performance of other entities managed or supported by New Mountain Capital;

· There is uncertainty as to the value of the Operating Company’s portfolio investments because most of its investments are, and may continue to be in private companies and recorded at fair value. In addition, because NMFC is a holding company, the fair values of the Operating Company’s investments are determined by the Operating Company’s board of directors in accordance with the Operating Company’s valuation policy;

· The Operating Company’s ability to achieve its investment objective depends on key investment personnel of the Investment Adviser. If the Investment Adviser were to lose any of its key investment personnel, the Operating Company’s ability to achieve its investment objective could be significantly harmed;

· The Investment Adviser has limited experience managing a BDC or a RIC, which could adversely affect our business;

· The Operating Company operates in a highly competitive market for investment opportunities and may not be able to compete effectively;

· Our business, results of operations and financial condition depends on the Operating Company’s ability to manage future growth effectively;

· The Operating Company borrows money, which could magnify the potential for gain or loss on amounts invested in us and increase the risk of investing in us;

· Changes in interest rates may affect the Operating Company’s cost of capital and net investment income;

S-8

· Regulations governing the operations of BDCs will affect our ability to raise additional equity capital as well as our ability to issue senior securities or borrow for investment purposes, any or all of which could have a negative effect on our investment objectives and strategies;

· We may experience fluctuations in our annual and quarterly results due to the nature of our business;

· The Operating Company’s board of directors may change its investment objective, operating policies and strategies without prior notice or member approval, the effects of which may be adverse to your interest as a stockholder;

· NMFC will be subject to corporate-level federal income tax on all of its income if it is unable to maintain RIC status under Subchapter M of the Code, which would have a material adverse effect on its financial performance;

· NMFC may not be able to pay you distributions on its common stock, its distributions to you may not grow over time and a portion of its distributions to you may be a return of capital for federal income tax purposes;

· The Operating Company’s investments in portfolio companies may be risky, and the Operating Company could lose all or part of any of its investments;

· The lack of liquidity in the Operating Company’s investments may adversely affect our business;

· Economic recessions or downturns could impair the Operating Company’s portfolio companies and harm its operating results;

· NMFC is a holding company with no direct operations of its own, and will depend on distributions from the Operating Company to meet its ongoing obligations;

· The market price of NMFC’s common stock may fluctuate significantly; and

· Sales of substantial amounts of NMFC’s common stock in the public market may have an adverse effect on the market price of its preferred stock.

· If NMFC issues preferred stock, the net asset value and market value of NMFC’s common stock will likely become more volatile.

· Holders of any preferred stock NMFC might issue would have the right to elect members of our board of directors and class voting rights on certain matters.

· [Insert any additional risk factors applicable to warrants.]

See “Risk Factors” beginning on page [ ] of the accompanying prospectus and the other information included in the accompanying prospectus, for additional discussion of factors you should carefully consider before deciding to invest in the warrants.

Company Information

Our administrative and executive offices are located at 787 Seventh Avenue, 48th Floor, New York, New York 10019, and our telephone number is (212) 720-0300. We maintain a website at http://www.newmountainfinance.com. Information contained on our website is not incorporated by reference into this prospectus supplement and the accompanying prospectus, and you should not consider information contained on our website to be part of this prospectus supplement and the accompanying prospectus.

S-9

Presentation of Historical Financial Information and Market Data

Historical Financial Information

Unless otherwise indicated, historical references contained in the accompanying prospectus in “Selected Financial and Other Data”, “Selected Quarterly Data”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Senior Securities” and “Portfolio Companies” relate to the Operating Company, which is NMFC’s sole investment. The consolidated financial statements of New Mountain Finance Holdings, L.L.C., formerly known as New Mountain Guardian (Leveraged), L.L.C., and New Mountain Guardian Partners, L.P. are the Operating Company’s historical consolidated financial statements.

Market Data

Statistical and market data used in this prospectus supplement and the accompanying prospectus has been obtained from governmental and independent industry sources and publications. We have not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained in this prospectus supplement and the accompanying prospectus. See “Cautionary Statement Regarding Forward-Looking Statements”.

S-10

SPECIFIC TERMS OF OUR WARRANTS AND THE OFFERING

This prospectus supplement sets forth certain terms of our warrants that we are offering pursuant to this prospectus supplement and supplements the accompanying prospectus that is attached to the back of this prospectus supplement. This section outlines the specific legal and financial terms of our warrants. You should read this section together with the more general description of our warrants in this prospectus supplement under the heading “Description of Our Warrants” and in the accompanying prospectus under the heading “Description of NMFC’s Warrants” before investing in our warrants. Capitalized terms used in this prospectus supplement and not otherwise defined shall have the meanings ascribed to them in the accompanying prospectus.

[Insert material terms of our warrants in tabular form to the extent required to be disclosed by applicable law or regulation.]

S-11

FEES AND EXPENSES

The following table is intended to assist you in understanding the costs and expenses that you will bear directly or indirectly. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus supplement and the accompanying prospectus contains a reference to fees or expenses paid by “you”, “NMFC”, the “Operating Company”, or “us” or that “we”, “NMFC”, or the “Operating Company” will pay fees or expenses, stockholders will indirectly bear such fees or expenses through NMFC’s investment in the Operating Company.

|

Stockholder transaction expenses: |

|

|

|

|

Sales load borne by us (as a percentage of offering price) |

|

|

%(1) |

|

Offering expenses borne by us (as a percentage of offering price) |

|

|

%(2) |

|

Dividend reinvestment plan expenses |

|

|

(3) |

|

Total stockholder transaction expenses (as a percentage of offering price) |

|

|

% |

|

|

|

|

|

|

Annual expenses (as a percentage of net assets attributable to common stock): |

|

|

|

|

Base management fee |

|

|

%(4) |

|

Incentive fees payable under our Investment Advisory and Management Agreement |

|

|

%(5) |

|

Interest payments on borrowed funds |

|

|

%(6) |

|

Other expenses (estimated) |

|

|

%(7) |

|

|

|

|

|

|

Total annual expenses (estimated) |

|

|

%(8) |

Example

The following example, required by the SEC, demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in NMFC’s warrants. In calculating the following expense amounts, we have assumed that our borrowings and annual operating expenses would remain at the levels set forth in the table above. See Note 6 below for additional information regarding certain assumptions regarding our level of leverage.

|

|

|

1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

|

|

You would pay the following expenses on a $1,000 investment, assuming a 5% annual return |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The example and the expenses in the tables above should not be considered a representation of future expenses, and actual expenses may be greater or less than those shown.

While the example assumes, as required by the applicable rules of the SEC, a 5.0% annual return, our performance will vary and may result in a return greater or less than 5.0%. The incentive fee under the Investment Management Agreement, which, assuming a 5% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is not included in the example. This illustration assumes that we will not realize any capital gains (computed net of all realized capital losses and unrealized capital depreciation) in any of the indicated time periods. If we achieve sufficient returns on our investments, including through the realization of capital gains, to trigger an incentive fee of a material amount, our expenses and returns to our investors would be higher. For example, if we assumed that we received our 5% annual return completely in the form of net realized capital gains on our investments, computed net of all cumulative unrealized depreciation on our investments, the projected dollar amount of total cumulative expenses set forth in the above illustration would be as follows:

|

|

|

1 Year |

|

3

Years |

|

5 Years |

|

10

Years |

|

|

You would pay the following expenses on a $1,000 investment, assuming a 5% annual return |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The example assumes no sales load. In addition, while the examples assume reinvestment of all distributions at net asset value, participants in NMFC’s dividend reinvestment plan will receive a number of NMFC’s warrants

S-12

determined by dividing the total dollar amount of the distribution payable to a participant by the market price per share of NMFC’s warrants at the close of trading on the dividend payment date. The market price per share of NMFC’s warrants may be at, above or below net asset value. See “Dividend Reinvestment Plan” in the accompanying prospectus for additional information regarding the dividend reinvestment plan.

(1) Represents the commission with respect to NMFC’s warrants being sold in this offering, which we will pay to in connection with sales of shares of NMFC’s warrants effected by in this offering. There is no guaranty that there will be any sales of NMFC’s warrants pursuant to this prospectus supplement and the accompanying prospectus.

(2) The offering expenses of this offering are estimated to be approximately $ .

(3) The de minimus expenses of the dividend reinvestment plan are included in “other expenses”.

(4) The base management fee under the Investment Management Agreement is based on an annual rate of 1.75% of the Operating Company’s average gross assets less (i) the average borrowings under the SLF Credit Facility and (ii) average cash and cash equivalents for the two most recent quarters. The base management fees reflected in the table above is based on the [ ] months ended [ ], 20[ ] and [ ], 20[ ]. See “Investment Management Agreement” in the accompanying prospectus.

(5) Assumes that annual incentive fees earned by the Investment Adviser remain consistent with the incentive fees earned by the Investment Adviser during the period from [ ], 20[ ] through [ ], 20[ ] and includes accrued capital gains incentive fee. As we cannot predict whether the Operating Company will meet the thresholds for incentive fees under the Investment Management Agreement, the incentive fees paid in subsequent periods, if any, may be substantially different than the fees incurred during the [ ] months ended [ ], 20[ ]. For more detailed information about the incentive fee calculations, see the “Investment Management Agreement” section of the accompanying prospectus.

(6) We may borrow funds from time to time to make investments to the extent we determine that additional capital would allow us to take advantage of additional investment opportunities or if the economic situation is otherwise conducive to doing so. The costs associated with these borrowings are indirectly borne by NMFC’s stockholders through its investment in the Operating Company. As of [ ], 20[ ], the Operating Company had $[ ] million and $[ ] million of indebtedness outstanding under the Holdings Credit Facility and the SLF Credit Facility, respectively. For purposes of this calculation, we have assumed the [ ], 20[ ] amounts outstanding under these credit facilities, and have computed interest expense using an assumed interest rate of [ ]% for the Holdings Credit Facility and [ ]% for the SLF Credit Facility, which were the rates payable as of [ ], 20[ ]. See “Senior Securities” in the accompanying prospectus.

(7) “Other expenses” include the New Mountain Finance Entities’ overhead expenses, including payments by the Operating Company under the Administration Agreement based on the allocable portion of overhead and other expenses incurred by the Administrator in performing its obligations to the New Mountain Finance Entities under the Administration Agreement. Pursuant to the Administration Agreement, and further restricted by the Operating Company, expenses payable to the Administrator by the Operating Company as well as other direct and indirect expenses (excluding interest and other credit facility expenses and management and incentive fees) have been capped at $3.5 million for the time period from April 1, 2012 to March 31, 2013 and capped at $4.25 million for the time period from April 1, 2013 to March 31, 2014. This expense ratio does not include any expense cap. Assuming $ [ ] million of annual expense, the expense ratio would be [ ]%. See “Administration Agreement” in the accompanying prospectus.

(8) The holders of shares of NMFC’s common stock indirectly bear the cost associated with our annual expenses through NMFC’s investment in the Operating Company.

S-13

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about us, the Operating Company’s current and prospective portfolio investments, our industry, our beliefs, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements. The forward-looking statements contained in this prospectus supplement involve risks and uncertainties, including statements as to:

· our future operating results; the Operating Company’s business prospects and the prospects of its portfolio companies;

· the impact of investments that the Operating Company expects to make;

· our contractual arrangements and relationships with third parties;

· the dependence of our future success on the general economy and its impact on the industries in which we invest;

· the ability of the Operating Company’s portfolio companies to achieve their objectives;

· the Operating Company’s expected financings and investments;

· the adequacy of our cash resources and working capital; and

· the timing of cash flows, if any, from the operations of the Operating Company’s portfolio companies.

These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

· an economic downturn could impair the Operating Company’s portfolio companies’ ability to continue to operate, which could lead to the loss of some or all of the Operating Company’s investments in such portfolio companies;

· a contraction of available credit and/or an inability to access the equity markets could impair our lending and investment activities;

· interest rate volatility could adversely affect our results, particularly if we elect to use leverage as part of our investment strategy;

· currency fluctuations could adversely affect the results of the Operating Company’s investments in foreign companies, particularly to the extent that we receive payments denominated in foreign currency rather than U.S. dollars; and

· the risks, uncertainties and other factors we identify in “Risk Factors” and elsewhere in this prospectus supplement, the accompanying prospectus and in our filings with the SEC.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include the Operating Company’s ability to originate new loans and investments, certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus supplement should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in “Risk Factors” and elsewhere in this prospectus supplement and the accompanying prospectus. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this prospectus supplement. However, we will update this prospectus supplement to reflect any material changes to the information contained herein. The forward-looking statements and projections contained in this prospectus supplement are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, or the Securities Act.

S-14

RISK FACTORS

Investing in our warrants involves a number of significant risks. Before you invest in our warrants, you should be aware of various risks, including those described below and those set forth in the accompanying prospectus. You should carefully consider these risk factors, together with all of the other information included in this prospectus supplement and the accompanying prospectus, before you decide whether to make an investment in our warrants. The risks set out below are not the only risks we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us may also impair our operations and performance. If any of the following events occur, our business, financial condition, results of operations and cash flows could be materially and adversely affected. In such case, our net asset value and the trading price of our common stock could decline, and you may lose all or part of your investment. The risk factors described below, together with those set forth in the accompanying prospectus, are the principal risk factors associated with an investment in us as well as those factors generally associated with an investment company with investment objectives, investment policies, capital structure or trading markets similar to ours.

[If you exercise your warrants, you may be unable to sell any [type of security] you purchase at a profit.

The public trading market price of our [type of security] may decline after you elect to exercise your warrants. If that occurs, you will have committed to buy [type of security] at a price above the prevailing market price and you will have an immediate unrealized loss. Moreover, we cannot assure you that following the exercise of warrants you will be able to sell your [type of security] at a price equal to or greater than the exercise price.

The exercise price is not necessarily an indication of our value.

The exercise price of the warrants does not necessarily bear any relationship to any established criteria for valuation of business development companies. You should not consider the exercise price an indication of our value or any assurance of future value. After the date of this prospectus supplement, our [type of security] may trade at prices above or below the subscription price.]

[Insert any additional relevant risk factors not included in the base prospectus to the extent required to be disclosed by applicable law or regulation.]

S-15

CAPITALIZATION

The following table sets forth our capitalization as of [ ], 20[ ]:

· on an actual basis; and

· on an as adjusted basis to give effect to the sale of NMFC warrants in this offering at an assumed public offering price of $ per share (the last reported closing price of NMFC’s warrants on , 20 ), after deducting the estimated underwriting discounts and commissions of approximately $ and estimated offering expenses of approximately $ payable by the Operating Company.

You should read this table together with “Use of Proceeds” and financial statements and related notes thereto included elsewhere in this prospectus supplement and the accompanying prospectus.

|

|

|

As of

[ ], 20[ ] |

|

|

|

|

Actual |

|

As Adjusted

(unaudited) |

|

|

|

|

(in thousands) |

|

|

Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

$ |

|

|

|

Investments at fair value |

|

|

|

|

|

|

Other assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

Credit facilities payable |

|

$ |

|

|

$ |

|

|

|

Other liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Net assets |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, par value $0.01 per share; 100,000,000 shares authorized, shares outstanding |

|

|

|

$ |

|

|

|

Capital in excess of par value |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

|

$ |

|

|

S-16

USE OF PROCEEDS

We estimate that we will receive net proceeds from the sale of the shares of NMFC’s warrants in this offering of approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional warrants in full, after deducting estimated offering expenses of approximately $ payable by the Operating Company.

The Operating Company intends to use the net proceeds from this offering for new investments in portfolio companies in accordance with the Operating Company’s investment objective and strategies described in this prospectus supplement and the accompanying prospectus, to temporarily repay indebtedness (which will be subject to reborrowing), to pay our operating expenses, to pay distributions to our stockholders/unit holders and for general corporate purposes. The Operating Company is continuously identifying, reviewing and, to the extent consistent with its investment objective, funding new investments. As a result, we typically raise capital as we deem appropriate to fund such new investments.

We estimate that it will take up to months for the Operating Company to substantially invest the net proceeds of this offering, depending on the availability of attractive opportunities and market conditions. However, we can offer no assurance that we will be able to achieve this goal.

Proceeds not immediately used for new investments or the temporary repayment of debt will be invested primarily in cash, cash equivalents, U.S. government securities and other high-quality investments that mature in one year or less from the date of investment. These temporary investments are expected to provide a lower net return than we hope to achieve from the Operating Company’s target investments.

S-17

DESCRIPTION OF OUR WARRANTS

This prospectus supplement sets forth certain terms of our warrants that we are offering pursuant to this prospectus supplement and the accompanying prospectus. This section outlines the specific legal and financial terms of our warrants. You should read this section together with the more general description of our warrants in the accompanying prospectus under the heading “Description of NMFC’s Warrants” before investing in our warrants. This summary is not necessarily complete and is subject to and entirely qualified by reference to [insert relevant documents].

[Insert material terms of our warrants to the extent required to be disclosed by applicable law or regulation.]

S-18

UNDERWRITING

NMFC, the Operating Company and the underwriters named below have entered into an underwriting agreement with respect to the warrants being offered. Subject to certain conditions, each underwriter has severally agreed to purchase the number of warrants indicated in the following table. [ ] are the representatives of the underwriters.

|

Underwriter |

|

Number

of Warrants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

The underwriters are committed to take and pay for all of the warrants being offered, if any are taken, other than the warrants covered by the option described below unless and until this option is exercised.

If the underwriters sell more warrants than the total number set forth in the table above, the underwriters have an option to buy up to an additional [ ] warrants from NMFC. They may exercise that option for [ ] days. If any warrants are purchased pursuant to this option, the underwriters will severally purchase warrants in approximately the same proportion as set forth in the table above.

The following table shows the per share and total underwriting discounts and commissions (sales load) to be paid to the underwriters by the Operating Company. Such amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase [ ] additional warrants. This offering will conform with the requirements set forth in Financial Industry Regulatory Authority Rule 2310. In compliance with such requirements, the underwriting discounts and commissions in connection with the sale of securities will not exceed 10% of gross proceeds of this offering.

|

|

|

No Exercise |

|

Full Exercise |

|

|

Per Warrant |

|

$ |

|

|

$ |

|

|

|

Total |

|

$ |

|

|

$ |

|

|

Warrants sold by the underwriters to the public will initially be offered at the public offering price set forth on the cover of this prospectus supplement. Any warrants sold by the underwriters to securities dealers may be sold at a discount of up to $ per warrant from the public offering price. If all the warrants are not sold at the initial offering price, the representatives may change the public offering price and the other selling terms. The offering of the warrants by the underwriters is subject to receipt and acceptance and subject to the underwriters’ right to reject any order in whole or in part.

S-19

NMFC, each of its officers and directors, and each of the members of the Investment Adviser’s investment committee have agreed with the underwriters, subject to certain exceptions, not to dispose of or hedge any of NMFC’s warrants or securities convertible into or exchangeable for NMFC’s warrants during the period from the date of this prospectus supplement continuing through the date [ ] days after the date of this prospectus supplement, except with the prior written consent of [ ].

The [ ]-day restricted period described in the preceding paragraph will be automatically extended if: (1) during the last [ ] days of the [ ]-day restricted period the NMFC issues an earnings release or announce material news or a material event; or (2) prior to the expiration of the [ ]-day restricted period, the NMFC announces that it will release earnings results during the [ ]-day period following the last day of the [ ]-day period, in which case the restrictions described in the preceding paragraph will continue to apply until the expiration of the [ ]-day period beginning on the issuance of the earnings release of the announcement of the material news or material event.

[NMFC’s warrants are listed on the [ ] under the symbol “[ ]”.]

In connection with the offering, the underwriters may purchase and sell warrants in the open market. These transactions may include short sales, stabilizing transactions and purchases to cover positions created by short sales. Short sales involve the sale by the underwriters of a greater number of warrants than they are required to purchase in the offering. “Covered” short sales are sales made in an amount not greater than the underwriters’ option to purchase additional warrants from us in the offering. The underwriters may close out any covered short position by either exercising their option to purchase additional warrants or purchasing warrants in the open market. In determining the source of warrants to close out the covered short position, the underwriters will consider, among other things, the price of warrants available for purchase in the open market as compared to the price at which they may purchase additional warrants pursuant to the option granted to them. “Naked” short sales are any sales in excess of such option. The underwriters must close out any naked short position by purchasing warrants in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the warrants in the open market after pricing that could adversely affect investors who purchase in the offering. Stabilizing transactions consist of various bids for or purchases of warrants made by the underwriters in the open market prior to the completion of the offering.

The underwriters may also impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the representatives have repurchased warrants sold by or for the account of such underwriter in stabilizing or short covering transactions.

Purchases to cover a short position and stabilizing transactions, as well as other purchases by the underwriters for their own account, may have the effect of preventing or retarding a decline in the market price of the company’s stock, and together with the imposition of the penalty bid, may stabilize, maintain or otherwise affect the market price of the warrants. As a result, the price of the warrants may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued at any time. These transactions may be effected on the New York Stock Exchange, in the over-the-counter market or otherwise.

The underwriters do not expect sales to discretionary accounts to exceed five percent of the total number of warrants offered.

We estimate that our share of the total expenses of the offering, excluding underwriting discounts and commissions, will be approximately $[ ]. The Operating Company will pay all of the expenses incurred by us in connection with this offering.

NMFC and the Operating Company have agreed to indemnify the several underwriters against certain liabilities, including liabilities under the Securities Act of 1933.

The underwriters and their respective affiliates are full-service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. Certain of the

S-20

underwriters and their respective affiliates may, from time to time, perform various financial advisory and investment banking services for the company, for which they will receive customary fees and expenses.

In the ordinary course of their various business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and such investment and securities activities may involve securities and/or instruments of the issuer. The underwriters and their respective affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

The principal business address of [ ], [ ], [ ], [ ] [ ].

Each of the underwriters may arrange to sell warrants offered hereby in certain jurisdictions outside the United States, either directly or through affiliates, where they are permitted to do so.

[Describe any other specific transactions and compensation related thereto to the extent required to be disclosed by applicable law or regulation.]

[Describe if underwriters receiving proceeds of offering, if required by FINRA.]

[Insert principal business addresses of underwriters.]

[Insert applicable legends for jurisdictions in which offers and sales may be made.]

S-21

LEGAL MATTERS

Certain legal matters in connection with the securities offered hereby will be passed upon for us by Sutherland Asbill & Brennan LLP, Washington, District of Columbia. Certain legal matters in connection with the securities offered hereby will be passed upon for the underwriters by , , .

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

With respect to the unaudited interim financial information of New Mountain Finance Holdings, L.L.C., New Mountain Finance Corporation and New Mountain Finance AIV Holdings Corporation as of September 30, 2013 and for the three and nine month periods ended September 30, 2013 and 2012, which is included in the accompanying prospectus, Deloitte & Touche LLP, an independent registered public accounting firm, has applied limited procedures in accordance with the standards of the Public Company Accounting Oversight Board (United States) for a review of such information. However, as stated in their report included in the accompanying prospectus, they did not audit and they do not express an opinion on that interim financial information. Accordingly, the degree of reliance on their report on such information should be restricted in light of the limited nature of the review procedures applied. Deloitte & Touche LLP are not subject to the liability provisions of Section 11 of the Securities Act of 1933 for their reports on the unaudited interim financial information because those reports are not “reports” or a “part” of the Registration Statement prepared or certified by an accountant within the meaning of Sections 7 and 11 of the Act.

The financial statements of New Mountain Finance Holdings, L.L.C. as of December 31, 2012 and 2011 and for each of the three years ended December 31, 2012, and the financial statements of New Mountain Finance Corporation and New Mountain Finance AIV Holdings Corporation as of December 31, 2012 and 2011, for the year ended December 31, 2012 and for the period from May 19, 2011 (Commencement of Operations) to December 31, 2011, including the Senior Securities table included in the accompanying prospectus, have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports appearing herein and elsewhere in the Registration Statement. Such financial statements and information included in the Senior Securities table as of December 31, 2012, 2011, 2010 and 2009 have been so included in reliance upon the reports of such firm, given their authority as experts in accounting and auditing.

The principal business address of Deloitte & Touche LLP is 30 Rockefeller Center Plaza, New York, New York 10112.

AVAILABLE INFORMATION

We have filed with the SEC a registration statement on Form N-2, together with all amendments and related exhibits, under the Securities Act, with respect to the warrants offered by this prospectus supplement and the accompanying prospectus. The registration statement contains additional information about us and the warrants being offered by this prospectus supplement and the accompanying prospectus.

We are required to file with or submit to the SEC annual, quarterly and current reports, proxy statements and other information meeting the informational requirements of the Exchange Act. You may inspect and copy these reports, proxy statements and other information, as well as the registration statement and related exhibits and schedules, at the Public Reference Room of the SEC at 100 F Street, N.E., Washington, District of Columbia 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information filed electronically by us with the SEC, which are available on the SEC’s website at http://www.sec.gov. Copies of these reports, proxy and information statements and other information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street, N.E., Washington, District of Columbia 20549. This information will also be available free of charge by contacting us at 787 Seventh Avenue, 48th Floor, New York, New York 10019, by telephone at (212) 720-0300, or on our website at http://www.newmountainfinance.com. Information contained on our website or on the SEC’s web site about us is not incorporated into this prospectus supplement and the accompanying prospectus and you should not consider information contained on our website or on the SEC’s website to be part of this prospectus supplement and the accompanying prospectus.

S-22

New Mountain Finance Corporation

Warrants to Purchase Up to [Type of Security]

PRELIMINARY PROSPECTUS SUPPLEMENT

[Underwriters]